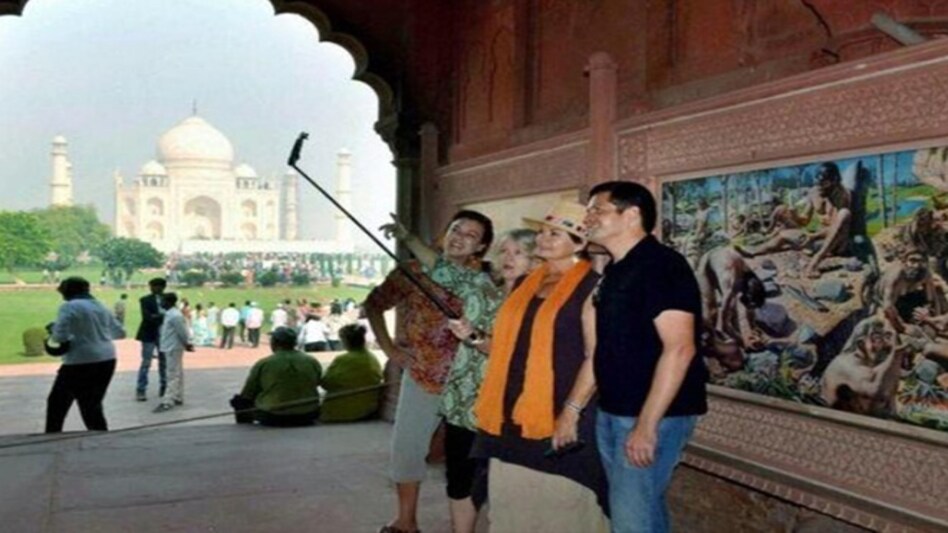

COVID knocked out tourism, can Budget 2021 revive it?

Several experts are of the view that the sector may take 3-4 years to fully recover and are expecting the Centre to grant long pending demand for industry status to the sector as well as lower GST rates, thereby giving direct relief, particularly to hotels

- Feb 1, 2021,

- Updated Feb 1, 2021 7:33 AM IST

The tourism and hospitality industry, which is one of the most-affected sectors due to the COVID-19 pandemic, has pinned high hopes on the Budget 2021.

The industry is seeking extensive support from the government in wake of unprecedented damage done by coronavirus crisis.

Several experts are of the view that the sector may take 3-4 years to fully recover and are expecting the Centre to grant long pending demand for industry status to the sector as well as lower GST rates, thereby giving direct relief, particularly to hotels.

Tourism

To ensure that there is a shared tourism vision across the Centre and states, the industry has proposed creation of a National Tourism Council of Chief Ministers headed by the Prime Minister along with the tourism minister, Federation of Associations in Indian Tourism and Hospitality (FAITH) recently said in a statement.

Also Read: Budget 2021

The federation has also asked for industry status for the tourism industry across the country by putting it in the concurrent list, it added.

"FAITH Associations collectively are engaging with different members of the government and look forward to getting a fair deal in the Union Budget," FAITH Consulting CEO Aashish Gupta said.

"FAITH has recommended export earnings be made tax free and also the incidence of taxes on tourism earnings be zero-rated. Additionally, Service Exports from India Scheme (SEIS) of 10 per cent to all foreign exchange earning members in tourism be made applicable for 5 years to ensure a post-COVID recovery," he added.

The sector is also expecting a concerted strategy to ensure that the tourism industry becomes a mainstay domestic industry. For this, measures like income tax exemption on travel within India, income tax credits of up to Rs 1.5 lakh when spending with GST registered domestic tour operators, travel agents, hoteliers, and transporters anywhere within the country are required, FAITH said.

"Tourism can drive GDP through CAPEX spending and to increase the intensity of high-quality hotel accommodation in India and MICE, all hotels & MICE venues across the country need to be tagged as vital social infrastructure," Gupta added.

FAITH also said it is critical to protect the business of Indian travel agents and tour operators and a structured mechanism is required to secure travel agents' payments in future, the statement said.

Also Read: Budget 2021: Date, time, sector-wise expectations; everything you need to know

Hotel and restaurants

The Federation of Hotel and Restaurant Associations of India (FHRAI) said specific to the business losses accrued due to COVID-19, it has recommended that a MAT (minimum alternative tax) waiver be given to the industry for a period of three years beginning April 2021.

It has also requested for treating payments received from international tourists as foreign exchange for the purpose of Export Promotion Capital Goods (EPCG) scheme and that the time to perform export obligation under the scheme be extended by 5 years.

"Over the last 8 months, the hospitality industry has been severely battered by the pandemic. The upcoming Union Budget will determine which way we go from here. The industry has a lot of expectations from the government," FHRAI Vice President Gurbaxish Singh Kohli said.

Since the industry has not received much support so far, FHRAI is hoping that the upcoming Budget will have special focus on the hospitality industry, he said.

Besides, the association expects that the budget would focus on certain longstanding demands, such as review of the Kamath Committee's recommendations, industry and infrastructure status for hotels, resorts and restaurants across the country, to raise threshold limit of hotel room tariffs for charging GST, to allow IGST billing to hotels for corporate and MICE bookings.

On the policy front, FHRAI demanded that hotels, resorts and restaurants should be accorded industry status. It has asked the government to classify hospitality under the RBI Infrastructure lending norm criteria for access to long-term funds, the statement said.

Thomas Cook (India) Chairman & MD Madhavan Menon said: "The travel and tourism industry has been one of the most severely impacted in the ongoing COVID-19 pandemic and we are staring at a long road to recovery".

While the government has rolled out economic relief packages for several industries, the tourism sector has been noticeably absent and the Union Budget offers valuable opportunity to address the crisis in the sector, he added.

Given its critical contribution to India's economy and its powerful multiplier impact on employment generation - an imperative at a time like this - the tourism industry deserves top priority in the Union Budget 2021, Menon said.

"I also look forward to the government support and priority action: soft loans to finance working capital, incentivising tourism spends by providing income tax concessions, payment of overdue SEIS benefits, easing of indirect taxes and waiving collector of tax (TCS) to help aid recovery," Menon said.

MakeMyTrip Founder and Group Executive Chairman Deep Kalra said that despite the impact of COVID-19 on the industry and without any aid in the form of a stimulus package, the industry is trying to find its feet and take initial steps towards recovery.

"We hope that in the upcoming budget the government takes note of the sector's role in the entire economic value chain and makes the long-due decision of including travel & tourism in the concurrent list," he added.

As domestic tourism holds the key to recovery, I-T deductions on domestic travel undertaken by the taxpayer will help in encouraging people to travel more domestically - further benefiting the larger ecosystem, he said.

"On the corporate travel front, the government should set sight on incentivising MICE (meetings, incentives, conferences and exhibitions) business - that would perhaps be the last to recover and offer 200 per cent weighted deduction to companies on MICE expenses over the next two years or more," Kalra said.

Bird Group Executive Director Ankur Bhatia said the most important and long-awaited measure the government must address in Budget 2021 is granting infrastructure status to the sector.

This would allow hotels to avail electricity, water and land at industrial rates as well as better infrastructure lending rates.(With inputs from PTI.)

The tourism and hospitality industry, which is one of the most-affected sectors due to the COVID-19 pandemic, has pinned high hopes on the Budget 2021.

The industry is seeking extensive support from the government in wake of unprecedented damage done by coronavirus crisis.

Several experts are of the view that the sector may take 3-4 years to fully recover and are expecting the Centre to grant long pending demand for industry status to the sector as well as lower GST rates, thereby giving direct relief, particularly to hotels.

Tourism

To ensure that there is a shared tourism vision across the Centre and states, the industry has proposed creation of a National Tourism Council of Chief Ministers headed by the Prime Minister along with the tourism minister, Federation of Associations in Indian Tourism and Hospitality (FAITH) recently said in a statement.

Also Read: Budget 2021

The federation has also asked for industry status for the tourism industry across the country by putting it in the concurrent list, it added.

"FAITH Associations collectively are engaging with different members of the government and look forward to getting a fair deal in the Union Budget," FAITH Consulting CEO Aashish Gupta said.

"FAITH has recommended export earnings be made tax free and also the incidence of taxes on tourism earnings be zero-rated. Additionally, Service Exports from India Scheme (SEIS) of 10 per cent to all foreign exchange earning members in tourism be made applicable for 5 years to ensure a post-COVID recovery," he added.

The sector is also expecting a concerted strategy to ensure that the tourism industry becomes a mainstay domestic industry. For this, measures like income tax exemption on travel within India, income tax credits of up to Rs 1.5 lakh when spending with GST registered domestic tour operators, travel agents, hoteliers, and transporters anywhere within the country are required, FAITH said.

"Tourism can drive GDP through CAPEX spending and to increase the intensity of high-quality hotel accommodation in India and MICE, all hotels & MICE venues across the country need to be tagged as vital social infrastructure," Gupta added.

FAITH also said it is critical to protect the business of Indian travel agents and tour operators and a structured mechanism is required to secure travel agents' payments in future, the statement said.

Also Read: Budget 2021: Date, time, sector-wise expectations; everything you need to know

Hotel and restaurants

The Federation of Hotel and Restaurant Associations of India (FHRAI) said specific to the business losses accrued due to COVID-19, it has recommended that a MAT (minimum alternative tax) waiver be given to the industry for a period of three years beginning April 2021.

It has also requested for treating payments received from international tourists as foreign exchange for the purpose of Export Promotion Capital Goods (EPCG) scheme and that the time to perform export obligation under the scheme be extended by 5 years.

"Over the last 8 months, the hospitality industry has been severely battered by the pandemic. The upcoming Union Budget will determine which way we go from here. The industry has a lot of expectations from the government," FHRAI Vice President Gurbaxish Singh Kohli said.

Since the industry has not received much support so far, FHRAI is hoping that the upcoming Budget will have special focus on the hospitality industry, he said.

Besides, the association expects that the budget would focus on certain longstanding demands, such as review of the Kamath Committee's recommendations, industry and infrastructure status for hotels, resorts and restaurants across the country, to raise threshold limit of hotel room tariffs for charging GST, to allow IGST billing to hotels for corporate and MICE bookings.

On the policy front, FHRAI demanded that hotels, resorts and restaurants should be accorded industry status. It has asked the government to classify hospitality under the RBI Infrastructure lending norm criteria for access to long-term funds, the statement said.

Thomas Cook (India) Chairman & MD Madhavan Menon said: "The travel and tourism industry has been one of the most severely impacted in the ongoing COVID-19 pandemic and we are staring at a long road to recovery".

While the government has rolled out economic relief packages for several industries, the tourism sector has been noticeably absent and the Union Budget offers valuable opportunity to address the crisis in the sector, he added.

Given its critical contribution to India's economy and its powerful multiplier impact on employment generation - an imperative at a time like this - the tourism industry deserves top priority in the Union Budget 2021, Menon said.

"I also look forward to the government support and priority action: soft loans to finance working capital, incentivising tourism spends by providing income tax concessions, payment of overdue SEIS benefits, easing of indirect taxes and waiving collector of tax (TCS) to help aid recovery," Menon said.

MakeMyTrip Founder and Group Executive Chairman Deep Kalra said that despite the impact of COVID-19 on the industry and without any aid in the form of a stimulus package, the industry is trying to find its feet and take initial steps towards recovery.

"We hope that in the upcoming budget the government takes note of the sector's role in the entire economic value chain and makes the long-due decision of including travel & tourism in the concurrent list," he added.

As domestic tourism holds the key to recovery, I-T deductions on domestic travel undertaken by the taxpayer will help in encouraging people to travel more domestically - further benefiting the larger ecosystem, he said.

"On the corporate travel front, the government should set sight on incentivising MICE (meetings, incentives, conferences and exhibitions) business - that would perhaps be the last to recover and offer 200 per cent weighted deduction to companies on MICE expenses over the next two years or more," Kalra said.

Bird Group Executive Director Ankur Bhatia said the most important and long-awaited measure the government must address in Budget 2021 is granting infrastructure status to the sector.

This would allow hotels to avail electricity, water and land at industrial rates as well as better infrastructure lending rates.(With inputs from PTI.)