The man who predicted the 2008 crash just made a $1.1 billion bet against tech

Burry’s move adds fuel to growing concerns that AI’s skyrocketing stock valuations are unsustainable. While Palantir posted “stellar” Q3 results, its shares plunged 7.95% on Tuesday—its worst drop since August. Nvidia shares also fell 3.96%. The tech-heavy Nasdaq slid over 2%, dragging the S&P 500 down by more than 1%.

- Nov 6, 2025,

- Updated Nov 6, 2025 9:17 AM IST

Michael Burry, the investor who foresaw the 2008 housing crash, is now betting that the AI boom is headed for a bust. His hedge fund has placed nearly $1.1 billion in bearish bets against two of the sector’s biggest names—Nvidia and Palantir.

In new SEC filings, Burry’s Scion Asset Management revealed it bought $187.6 million in puts against Nvidia and a staggering $912 million against Palantir. Puts are options contracts that gain value when a stock price falls—a sign Burry sees an AI market correction coming.

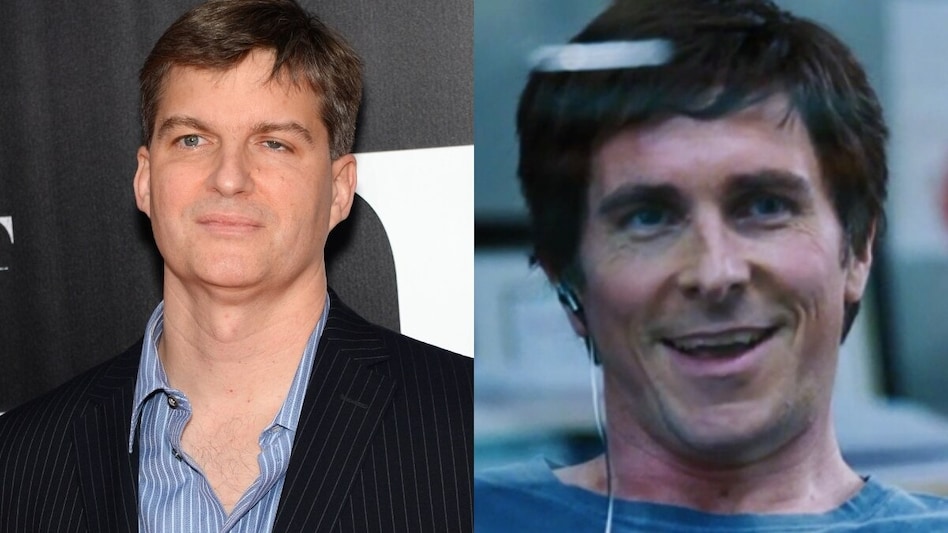

This latest bet comes just days after Burry broke a year-long silence on X, posting a cryptic message with a photo of Christian Bale portraying him in The Big Short. “Sometimes, we see bubbles. Sometimes, the only winning move is not to play,” he wrote.

Burry’s move adds fuel to growing concerns that AI’s skyrocketing stock valuations are unsustainable. While Palantir posted “stellar” Q3 results, its shares plunged 7.95% on Tuesday—its worst drop since August. Nvidia shares also fell 3.96%. The tech-heavy Nasdaq slid over 2%, dragging the S&P 500 down by more than 1%.

Palantir has surged 152% this year, making it one of the S&P 500’s top performers. Nvidia is up 48%. Yet many analysts are wary of the sector’s inflated prices. Angelo Zino of CFRA Research said the pullback was overdue and Burry’s comments likely triggered further market anxiety.

Palantir CEO Alex Karp fired back on CNBC, calling Burry’s bets “crazy.” He said shorts only motivate the company to beat expectations. “Every time they short us, we’re just tripling down on getting the better numbers... to make them poorer,” he said.

Burry has made dramatic market calls before—some accurate, others not. Still, his moves remain closely watched. With AI valuations stretched and investor skepticism growing, his bet could signal a turning point—or another misread.

Michael Burry, the investor who foresaw the 2008 housing crash, is now betting that the AI boom is headed for a bust. His hedge fund has placed nearly $1.1 billion in bearish bets against two of the sector’s biggest names—Nvidia and Palantir.

In new SEC filings, Burry’s Scion Asset Management revealed it bought $187.6 million in puts against Nvidia and a staggering $912 million against Palantir. Puts are options contracts that gain value when a stock price falls—a sign Burry sees an AI market correction coming.

This latest bet comes just days after Burry broke a year-long silence on X, posting a cryptic message with a photo of Christian Bale portraying him in The Big Short. “Sometimes, we see bubbles. Sometimes, the only winning move is not to play,” he wrote.

Burry’s move adds fuel to growing concerns that AI’s skyrocketing stock valuations are unsustainable. While Palantir posted “stellar” Q3 results, its shares plunged 7.95% on Tuesday—its worst drop since August. Nvidia shares also fell 3.96%. The tech-heavy Nasdaq slid over 2%, dragging the S&P 500 down by more than 1%.

Palantir has surged 152% this year, making it one of the S&P 500’s top performers. Nvidia is up 48%. Yet many analysts are wary of the sector’s inflated prices. Angelo Zino of CFRA Research said the pullback was overdue and Burry’s comments likely triggered further market anxiety.

Palantir CEO Alex Karp fired back on CNBC, calling Burry’s bets “crazy.” He said shorts only motivate the company to beat expectations. “Every time they short us, we’re just tripling down on getting the better numbers... to make them poorer,” he said.

Burry has made dramatic market calls before—some accurate, others not. Still, his moves remain closely watched. With AI valuations stretched and investor skepticism growing, his bet could signal a turning point—or another misread.