Banks can't afford affordable housing

Banks can't afford affordable housing

BusinessToday.In

- Jan 30, 2018,

- Updated Feb 6, 2018 8:37 PM IST

- 1/5

As affordable housing got a much needed push with the grant of infrastructure status in last year's budget, banks are seeing a rise in defaults in home loans of small ticket size.In the last two years, loans under Rs 10 lakh are the only ones which have seen a growth while growth rate of loans above Rs 25 lakh decreased by two third.

- 2/5

The number of people opting for loans less than Rs 10 lakh saw the maximum increase, while there was a decline in the number of people opting for loans above Rs 25 lakh.

- 3/5

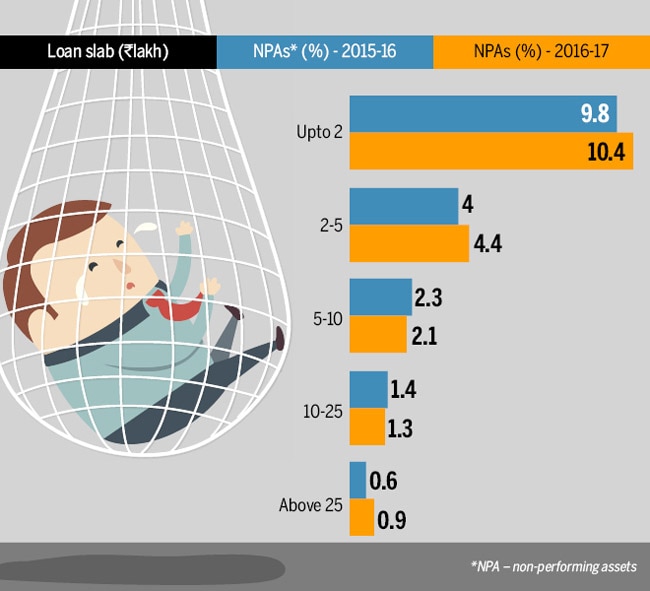

The increase in disbursement of sub-Rs 10 lakh loans has also led to an increase in defaults, especially for loans under Rs 2 lakh. In fact, the percentage of defaults in this category is more than the combined defaults in all other loan slabs.

- 4/5

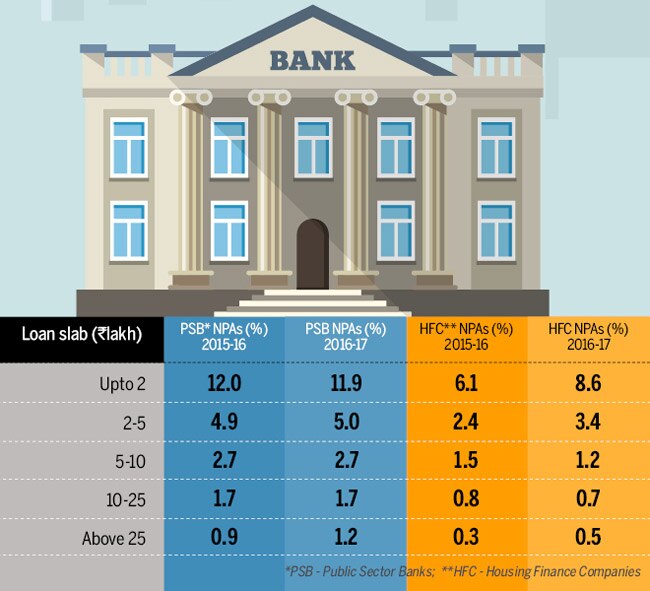

Public sector banks, because of the government mandate to push affordable housing, have a higher default rate in the small ticket size loan category, especially those under Rs 2 lakh, compared to housing finance companies.

- 5/5

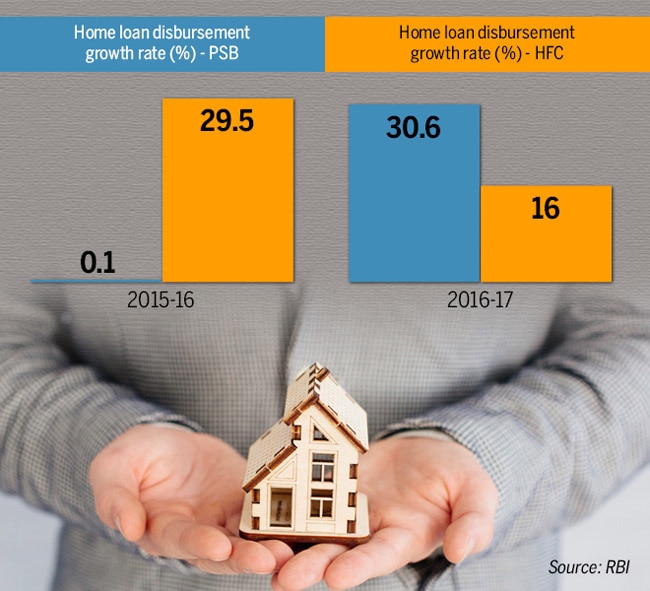

The growth rate of loans under Rs 10 lakh for public sector banks is nearly twice as much as that of housing finance companies.