Compound your coffee, compound your cash: How your 20s can make you crorepati by 40

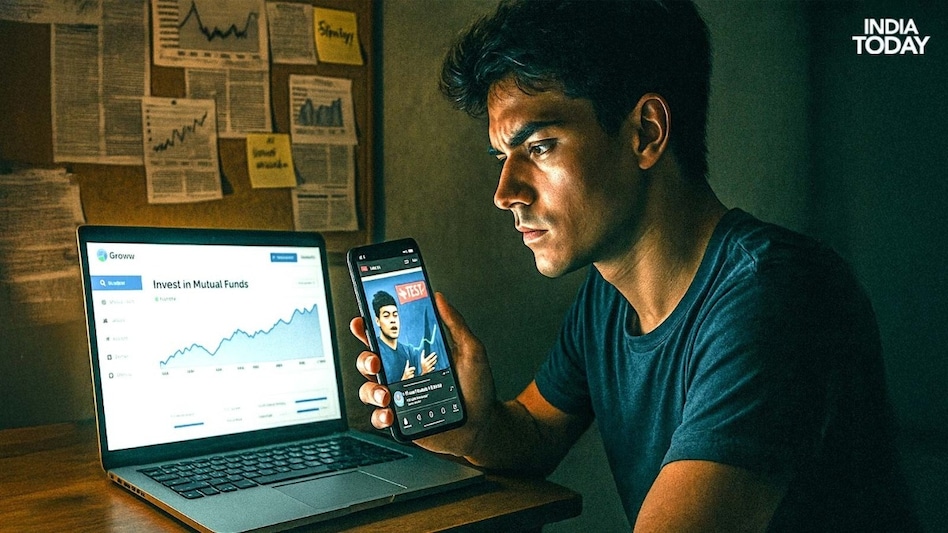

India’s Gen Z is transforming the investment landscape, with nearly half of mutual fund investors today under 30. Experts say the ideal age to start investing is 21–25, when early discipline and compounding can turn small SIPs into significant long-term wealth.

- Aug 19, 2025,

- Updated Aug 19, 2025 6:20 PM IST

As India’s Gen Z workforce steps into its prime earning years, the way they manage money is becoming more crucial than ever. Savings accounts and digital wallets may offer safety, but real financial growth demands early and consistent investing. Experts agree that the best time to begin investing is as soon as you earn your first paycheck—typically between the ages of 21 and 25. “Starting early allows your money more years to benefit from compounding, which can turn small monthly amounts into significant wealth over time,” says Ashok Manwani, Vice President – Products, Go Digit Life Insurance. By beginning early, young adults can grow wealth steadily without the stress of making large contributions later in life.

Impact on long-term wealth

Starting early builds financial discipline, leverages compounding, and provides a cushion against risks. Experts recommend Gen Z begin with equity SIPs, term life, and health insurance. Over time, adding ELSS or ULIPs can enhance growth and tax benefits, while insurance safeguards wealth from unexpected financial and medical shocks.

Financial discipline: Early investing builds habits that help young adults manage money wisely.

Compounding: Investments grow exponentially over decades, amplifying long-term returns.

Risk cushion: With time on their side, young investors can take calculated risks and ride out market volatility.

First Steps: Where to Invest and Insure

According to Yogesh Agarwal, CEO and Founder of Onsurity, the simplest strategy is often the best:

Begin with equity mutual fund SIPs for wealth creation.

Take a term life insurance policy to protect dependents.

Add health insurance early, as premiums are lower for the young.

Over time, consider ELSS or ULIPs for tax benefits and hybrid growth.

Insurance plays a critical role alongside investments. Term life insurance ensures family security, while critical illness cover and health insurance protect savings from unexpected medical shocks. These products also come with tax benefits under Sections 80C and 10(10D), improving financial efficiency.

Smart strategies for Gen Z

Maintain a 70:30 equity-debt ratio in your portfolio initially, adjusting with age.

Keep an emergency fund to avoid dipping into investments during crises.

Automate SIPs to stay consistent and resist the temptation of impulsive spending.

Avoid high-interest debt such as credit cards, which erodes gains.

Review your portfolio annually to realign with changing goals and responsibilities.

| Insurance Tool | Purpose | Why it’s recommended | Best For |

| Term Life Insurance | Financial protection for dependents | Low premium, high coverage, ideal for early start | Young earners with loans or family responsibilities |

| Health Insurance | Covers medical and hospitalization expenses | Essential for emergencies and rising healthcare costs | Everyone, especially those without employer coverage |

| Personal Accident Insurance | Covers disability or death due to accidents | Affordable and useful for active lifestyles | Those in high-risk jobs or frequent travellers |

| Critical Illness Cover | Lump sum payout on diagnosis of major illnesses | Helps manage high treatment costs | Individuals with family history of illness |

| ULIP (Unit Linked Insurance Plan) | Combines insurance with investment | Long-term wealth creation + life cover | Those wanting hybrid plans (with caution) |

The trends

A recent PhonePe Wealth study revealed that nearly 48% of mutual fund investors in India today are aged between 18 and 30, with most of them coming from Tier-2 cities rather than metros. In July 2025 alone, net inflows into equity mutual funds surged 28% month-on-month to Rs 42,702 crore, supported largely by systematic investment plans (SIPs). In fact, 92% of Gen Z investors prefer SIPs, contributing an average of Rs 1,000 monthly. According to AMFI, the total number of SIP accounts hit a record 911.18 lakh in July 2025.

The bottom line

The sooner Gen Z starts investing, the greater their advantage. Combining early investments with affordable insurance creates a secure financial foundation that protects against life’s uncertainties while building lasting wealth. Starting in your early 20s doesn’t just make you wealthier—it makes you financially resilient.

Track live Budget updates, breaking news, expert opinions and in-depth analysis only on BusinessToday.in

As India’s Gen Z workforce steps into its prime earning years, the way they manage money is becoming more crucial than ever. Savings accounts and digital wallets may offer safety, but real financial growth demands early and consistent investing. Experts agree that the best time to begin investing is as soon as you earn your first paycheck—typically between the ages of 21 and 25. “Starting early allows your money more years to benefit from compounding, which can turn small monthly amounts into significant wealth over time,” says Ashok Manwani, Vice President – Products, Go Digit Life Insurance. By beginning early, young adults can grow wealth steadily without the stress of making large contributions later in life.

Impact on long-term wealth

Starting early builds financial discipline, leverages compounding, and provides a cushion against risks. Experts recommend Gen Z begin with equity SIPs, term life, and health insurance. Over time, adding ELSS or ULIPs can enhance growth and tax benefits, while insurance safeguards wealth from unexpected financial and medical shocks.

Financial discipline: Early investing builds habits that help young adults manage money wisely.

Compounding: Investments grow exponentially over decades, amplifying long-term returns.

Risk cushion: With time on their side, young investors can take calculated risks and ride out market volatility.

First Steps: Where to Invest and Insure

According to Yogesh Agarwal, CEO and Founder of Onsurity, the simplest strategy is often the best:

Begin with equity mutual fund SIPs for wealth creation.

Take a term life insurance policy to protect dependents.

Add health insurance early, as premiums are lower for the young.

Over time, consider ELSS or ULIPs for tax benefits and hybrid growth.

Insurance plays a critical role alongside investments. Term life insurance ensures family security, while critical illness cover and health insurance protect savings from unexpected medical shocks. These products also come with tax benefits under Sections 80C and 10(10D), improving financial efficiency.

Smart strategies for Gen Z

Maintain a 70:30 equity-debt ratio in your portfolio initially, adjusting with age.

Keep an emergency fund to avoid dipping into investments during crises.

Automate SIPs to stay consistent and resist the temptation of impulsive spending.

Avoid high-interest debt such as credit cards, which erodes gains.

Review your portfolio annually to realign with changing goals and responsibilities.

| Insurance Tool | Purpose | Why it’s recommended | Best For |

| Term Life Insurance | Financial protection for dependents | Low premium, high coverage, ideal for early start | Young earners with loans or family responsibilities |

| Health Insurance | Covers medical and hospitalization expenses | Essential for emergencies and rising healthcare costs | Everyone, especially those without employer coverage |

| Personal Accident Insurance | Covers disability or death due to accidents | Affordable and useful for active lifestyles | Those in high-risk jobs or frequent travellers |

| Critical Illness Cover | Lump sum payout on diagnosis of major illnesses | Helps manage high treatment costs | Individuals with family history of illness |

| ULIP (Unit Linked Insurance Plan) | Combines insurance with investment | Long-term wealth creation + life cover | Those wanting hybrid plans (with caution) |

The trends

A recent PhonePe Wealth study revealed that nearly 48% of mutual fund investors in India today are aged between 18 and 30, with most of them coming from Tier-2 cities rather than metros. In July 2025 alone, net inflows into equity mutual funds surged 28% month-on-month to Rs 42,702 crore, supported largely by systematic investment plans (SIPs). In fact, 92% of Gen Z investors prefer SIPs, contributing an average of Rs 1,000 monthly. According to AMFI, the total number of SIP accounts hit a record 911.18 lakh in July 2025.

The bottom line

The sooner Gen Z starts investing, the greater their advantage. Combining early investments with affordable insurance creates a secure financial foundation that protects against life’s uncertainties while building lasting wealth. Starting in your early 20s doesn’t just make you wealthier—it makes you financially resilient.

Track live Budget updates, breaking news, expert opinions and in-depth analysis only on BusinessToday.in