What are the two cheapest things on the stock market? Advice and opinion, of course! Everyone has an opinion about “where things are headed” and what the next “big moneymaking idea” is going to be. But do any of these self-styled experts track their advice and keep score on how their ideas are making (or burning) money for you? We will.

MONEY TODAY will bridge the gap between advice and action in collaboration with Wealth Management Advisory Services, a portfolio management company. This fortnight we are introducing two rationally managed “open portfolios”. Both are designed with the long-term investor in mind. However, even long-term investors have different attitudes to risk and we have catered to that.

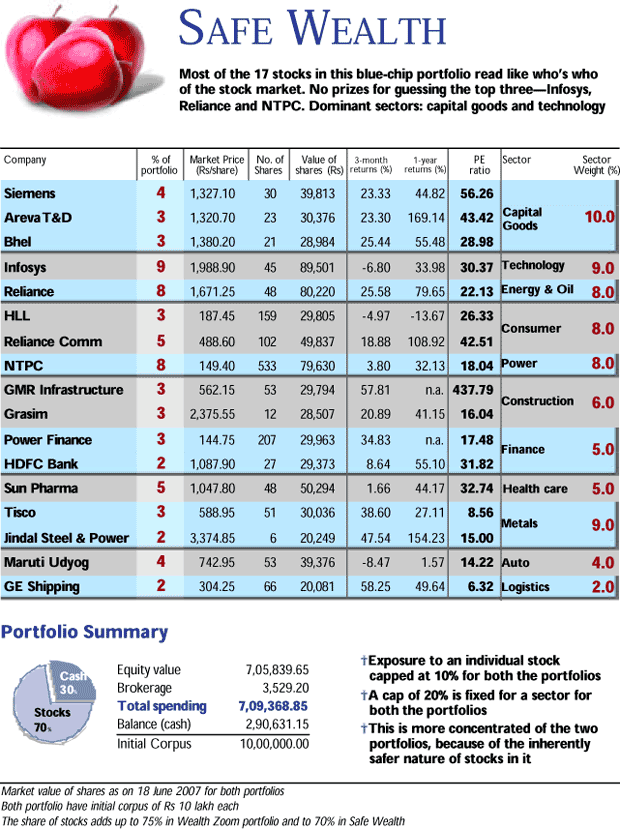

One of the two portfolios— “Safe Wealth”—is designed for a conservative investor, who wishes to hold blue chips and earn a relatively safe return without risking capital. You have probably heard of every company in this portfolio but of course, we have picked through the blue-chip universe in order to choose the stocks that we believe will yield higher returns. The other portfolio, “Wealth Zoom”, is for those who don’t mind taking calculated risks in search of exceptional long-term growth. This portfolio contains stocks that are somewhat less well-known and therefore, somewhat more risky.

Both portfolios can be replicated easily by the individual investor. We have suggested the proportions in which to buy the individual stocks. Once the initial portfolio is created, there won’t be a massive churn. Our virtual corpus assumes that investors are starting with a commitment of Rs 10 lakh. You could change the amount committed as you consider convenient while maintaining the same proportions.

Not all our resources will be committed instantly to the stock market. We are holding something back in the hope that we can invest more as opportunities arise.

We will assume a zeroreturn on the cash. This is in contrast to a normal equity diversified fund, which would get a return of 6% by parking cash in liquid money market instruments until it found stocks to buy. We are deliberately foregoing this return in our calculations. Our idea is to track only stock returns. We will track these two portfolios in every issue of MONEY TODAY and tell you when we are making changes as well as explaining why we are buying or selling any stock.

What follows are the details of the two portfolios and answers to questions you are most likely to ask about our methodology, rationale and investing style:

WHY TWO PORTFOLIOS?

The first one, called Safe Wealth, will comprise mostly blue chips, large caps and industry lead -ers whose managements (and their actions) have been consistently world class and where there is sufficient reason to expect more of the same. The second o n e , called Wealth Zoom, will comprise a slightly riskier profile of relatively undiscovered stocks where growth prospects are more aggressive. To begin with, we will start with a corpus of Rs 10 lakh in each portfolio. Over each fortnight we will decide what to buy or sell, and use the closing price of the fortnight as our assumed price for buying and selling. We will also load this price with 0.5% transaction charges that should comfortably cover brokerage and related charges and taxes. This is to make the portfolio changes more realistic.

Investing Rule 1: Use cash cautiously

To begin with, we are going to invest cautiously, choosing to remain 30% in cash for our Safe Wealth portfolio and 25% in the Wealth Zoom. As we move forward, we might average out our posi -tions in some stocks and reduce cash progressively.

Investing Rule 2: Diversify across stocks

It’s easy to get carried away while picking stocks. A basic element of discipline in our portfolios is that we will cap exposure to an individual stock at 10%, even if we think it’s a multi-bagger. Typically, any item at 4% and above tells you that we are strongly convinced about it. The redoubtable Warren Buffett says that diversification is a hedge against ignorance, but for us it’s also a hedge against timing error.

You can never predict when a good stock will catch the market’s fancy and go ballistic. And if you want to hold on to large dollops of something patiently till it finally delivers the goodies, then your performance may get lumpy over time. That’s why we will avoid building a concentrated portfolio. With a cap of 20 stocks, our Safe Wealth portfolio is generally going to be a little more concentrated than the Wealth Zoom portfolio. This is due to the inherently “safer” nature of stocks here. A cap of 25 stocks or so should do fine for Wealth Zoom. These are broad guidelines rather than set in stone and we will probably work around them every so often.

Investing Rule 3: Allocate across sectors

Next comes sectoral capping. It’s difficult to define a finite number of sectors but we have compiled this list of 13 broad sectors that, hopefully, captures the underlying industry segments adequately well.

It is in our sectoral allocations that you will find the underlying message that comes with our portfolios. The heavyweight sectors in each portfolio will tell you exactly where we see the proxies for economic growth in India.

A ceiling of 20% for any sector should work here. Of course, there is no such thing as a floor for sectoral allocation. Our first-cut portfolios in the following pages tell you that textiles and chemicals are sectors that don’t really catch our fancy.

How did we pick our stocks?

India is a growth economy and we decided to back growth while paying due attention to safety and valuations. That means whenever we had a choice between two businesses that have equally strong balance sheets, we chose the one with higher growth prospects.

Can I just pick a company or two from the portfolios?

Yes you can, but this will instantly change your risk-return profile. We are confident about the consolidated returns our portfolios will generate. But any given stock may generate a return that differs wildly from the overall portfolio return (see High Volatility Higher Returns pg 46). So, don’t blame us if you pick one stock at random and that happens to generate low returns (if you do manage to unerringly pick the best performer(s), please tell us how you did it!).

How can you track the performance of portfolios?

We will track the two portfolios using methods similar to mutual funds with one important difference. Every fortnight, when we give you an update on actions, we will also release an NAV. You can compare the change in that NAV to changes in the Nifty. Suppose a mutual fund raises Rs 10 lakh by selling one lakh units of Rs 10 each. It puts the money into various assets while also paying for its overheads, brokerages and meet any other expenses. The initial NAV is a little less than the initial price of Rs 10.

As NAV rises, you can benchmark the appreciation versus a stock market index. We will use a similar NAV-based method to track the two portfolios. We are assuming the portfolios were launched on an initial date of 18 June. Our initial NAVs as of 18 June is Rs 9.96 for the two portfolios. Every fortnight, we will give you an update on the performance of the portfolios.

Tracking the past to test Wealth Zoom portfolio

Just to give you an idea of how this works, we have backtracked and generated NAV on the Wealth Zoom portfolio since 1 January 2006 (see graph above). We have assumed all shares in the portfolio were bought in the same proportions in January 2006 and held without any changes till now.

This is only broadly indicative since the proportions of our holdings would have changed in that period, simply due to price fluctuations and several of the companies we have chosen weren’t listed in January 2006.

Our Wealth Zoom portfolio commits roughly 75% of Rs 10 lakh corpus into stocks and the rest in cash. Equity mutual funds hold cash in liquid money market instruments, which are currently offering an annualised yield of 6%. The value of the stocks in our Wealth Zoom portfolio on 31 May 2007 was Rs 7.64 lakh. Buying the identical portfolio (same stocks in the same proportion as in Wealth Zoom) would have cost only Rs 4.4 lakh on 2 January 2006.

Assuming that we had started with a corpus of Rs 10 lakh in January 2006, we would have had cash to the tune of Rs 5.59 lakh which we could have parked in money market funds that returned 6% per annum. The cash component at end-May 2007 would be about Rs 6.09 lakh. Thus, the NAV per unit at the end of May 2007 would be Rs 13.73 (inclusive of cash, stocks, income but excluding dividends).

Here’s where we differ in our reporting style from a standard fund. We are going to assume a zeroreturn on cash in our future NAV. This is to increase our incentive to be as fully invested in stocks as possible at all times.

Backtracking the equity component of the Wealth Zoom portfolio shows over 70% increase in the value of stocks that comprise this portfolio (Rs 4.4 lakh growing to Rs 7.6 lakh) since January 2006. This is much higher than the 52% increase in the value of Nifty during the same period of time. Yet our overall hypothetical NAV has risen only by 37% (Rs 13.73). The huge cash component has dragged down total returns. This should help you understand why the proportion of asset allocation is as important as picking the right assets.

Please note that this is a completely notional exercise designed to help you get a sense of how portfolio management works. If we had actually put together two portfolios in January 2006, our holdings and proportions would have been different. We would also have churned more. Also, don’t assume that the future performance of a portfolio will resemble the past performance. We will explain our choices of stocks from the next issue. For now, we are waiting for your reactions. We also await your suggestions on what other stocks we can add.