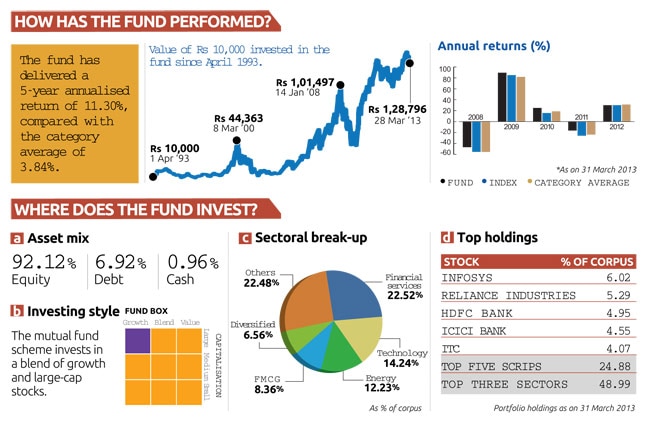

Canara Robeco Equity Tax Saver has outperformed its category average four times in the past five years.

FUND FACTS

INCEPTION: April 1993

CATEGORY: Equity tax planning

TYPE: Open-ended

AUM: Rs 551.88 crore

BENCHMARK INDEX: BSE 100

WHAT IT COSTS

NAV: Rs 27.89 (G), Rs 17.15 (D)

MIN INVESTMENT:Rs 500

MIN SIP AMOUNT:Rs 500

EXPENSE RATIO:2.29%

EXIT LOAD:Nil

WHO SHOULD INVEST IN IT?

Canara Robeco Equity Tax Saver maintains a diversified portfolio consistently with a large- and mid-cap growth orientation and the flexibility to invest in small-cap stocks at opportune times. Over the past five years, energy, financial services and technology have been part of the top five sectors.

The fund has maintained a compact portfolio without compromising on diversification. It consistently beats its benchmark, irrespective of the timing of one's investment, making it a good addition to a core portfolio.

However, the frequent change in fund management in recent years is a cause of concern for investors.

MEET THE FUND MANAGER

Fund manager Krishna Sanghvi has been at the helm since September 2012. "Stocks are selected based on fundamentals of business, industry structure, quality of management, sensitivity to economic factors, financial strength and key earnings drivers," he says.

Data and analysis of the fund have been sourced from Value Research