India's logistics sector is firing on all cylinders. The Centre's push to manufacturing and possibility of higher economic growth have been pushing up stocks of logistics companies, which on an average gave 217% returns in 2014 compared to 30% rise in the BSE Sensex. They had returned -11%, 20% and -35% in 2013, 2012 and 2011, respectively. The Sensex had moved 8.2% 25.29% and -24.83%, respectively, in these years. The sector includes warehousing, transportation, inventory and packaging industries. It has been growing over 16% a year on an average for the past five years.

In 2014, the stock of Patel Integrated Logistics rose 982% to Rs 153.25. It was followed by GATI (496% to Rs 281.75), Transport Corporation of India (190% to Rs 264), Sical Logistics (189% to Rs 165.35) and Allcargo Logistics (178% to Rs 328.30). "The industry is key to domestic and international trade. It is directly linked to economic growth," says Adarsh Hegde, executive director, Allcargo Logistics.

Hegde said there was growing expectation that the economy was picking up steam. "The sentiment is improving with inflation under control and economic activity becoming visible. Anticipation of business-friendly policies, infrastructure development and GST LOGISTICS(goods and services tax) is making many companies look at logistics service providers for making supply chains more efficient," he said. GST is a value-added tax that the government is working on. It will replace indirect taxes levied by central and state governments on goods and services and increase trade, helping logistics companies.

"Logistics stocks rose mainly due to the boom in e-commerce. As e-commerce companies are not listed, investors took indirect exposure via logistics stocks as e-commerce relies heavily on logistics companies," says Yogesh Nagaonkar, vice president, institutional equities, Bonanza Portfolio. An Assocham-Pwc study has found that the average annual spending by Indians on online purchases is expected to rise 67% to Rs 10,000 next year; at present, the figure is Rs 6,000. The industry, valued at $17 billion and growing at a compound annual growth rate of 35%, will cross the $100-billion mark in the next five years.

Valuation & Outlook

On January 8, trailing 12 months price-to-earnings (PE) ratios of GATI, Sical Logistics, Snowman Logistics, Allcargo Logistics, Patel Integrated Logistics and Gateway Distriparks were 94.17, 84.46, 70.23, 63.33, 56.58 and 50.66, respectively; the industry average was 32.53. Sanco Trans, Container Corporation of India, Transport Corporation of India, Aegis Logistics, Tiger Logistics (India), Agarwal Industrial Corporation were at PE ratios of less than 32. A stock's P/E ratio tells how much investors are willing to pay for every rupee earned by the company. "Valuations are a major concern. Many frontline companies are at high P/Es," says Alex Mathews, head of research, Geojit BNP Paribas Financial Services. The year 2015 is likely to be good for the sector as the economy revives. "With the government's 'Make in India' push, more companies will focus on manufacturing in India, which will require an efficient logistics sector. Moreover, with the economy expected to grow fast, global trade will rise exponentially, positively impacting the logistics industry. This will be one of the best years for the industry," says Hegde of Allcargo Logistics.

Issues and Problems

Factors to Watch

One of the biggest points investors must look at is the growth of the industry. Second, they must understand the regulations and policies that will help the industry grow. For example, GST will be a game changer for logistics companies. Mathews says, "Passing of the GST Bill can act as a trigger for the sector. Growth of e-commerce is another factor which can act as a catalyst. Policies to improve the country's infrastructure will also act as support. More trade will also help logistics companies."

Investment Options

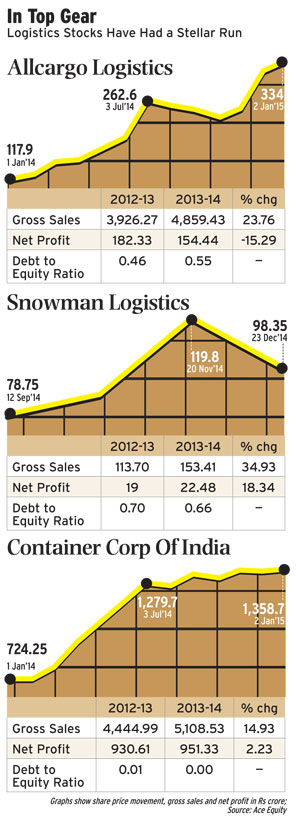

Snowman Logistics: It is an integrated logistics service provider with 21 temperature-controlled warehouses at 13 locations. Its stock rose 20% to Rs 94.25 between January 9 and September 12 last year. Agrawal of WealthRays Securities says, "The organised sector is expected to grow at a rapid pace. Introduction of the GST Bill has given a boost to these companies. Snowman is planning to rapidly expand in the cold storage space. There is also a possibility of more foreign investment in the company."

Allcargo Logistics: The company is one of the largest LCL (less-than-container load) consolidation players in the world. LCL is a shipment that will not fill a container. With an LCL shipment, you pay for your load to be shipped in a container with one or more loads from other customers. Allcargo's services include global multi-modal transport, container freight station, inland container depot and project and engineering solutions. It operates in more than 90 countries.

A BP Equities report issued in December said Allcargo had a strong presence in the non-vessel owning common carrier business through the wide network of ECU Line, a Belgium-based company in which it has a stake, and a strong hold on domestic multi-modal transport operations. In view of faster economic growth and higher demand, BP Equities expects increase in utilisation rates of CFS (container freight station) and P&E (project and engineering) segments. At present, the stock is trading at 10.5 times 2016-17 earnings estimates. The brokerage believes the stock can touch Rs 445 in the next 18-24 months. It was at Rs 323.90 on January 9.

Container Corporation of India: Over the years, the company has diversified into several container logistics activities such as container port, air cargo complex, air freight station, warehousing, logistics park and supply-chain management. The stock rose 82% to Rs 1,368 in 2014. According to an ICICI Securities report, the introduction of GST is expected to increase volumes manifold. Container Corporation of India, with its countrywide network and footprint at all container ports, including the private ones, is expected to be a major beneficiary, said the report

In 2014-15, container volumes at all major ports grew 8% year-on-year. With the economy expected to improve, the growth will be steeper. The brokerage says the stock can touch Rs 1,670 in the next 12 months.

"Improvement in the country's economy will boost top line. The stock can be bought at current market price for a target of Rs 1,500," says Agrawal of WealthRays.