|

| Click to see Safe Wealth portfolio |

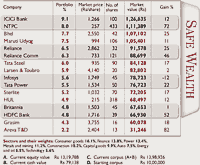

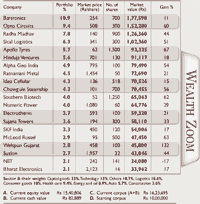

What a start to the new year! The mid-cap momentum over the fortnight ending 2 January has propelled our Wealth Zoom portfolio to the top of the charts with a handsome 62% gain since June 2007, when we launched it. With a shade under 40% gained in the Safe Wealth portfolio, our conservative stock picks are finally getting out gunned by their aggressive cousins in Wealth Zoom.

Let’s see if this persists. If you are thinking that I’m celebrating as your fund manager, think again. In my usual cowardly style, I’m tempted to sell large chunks and lock in some neat profits, especially the smaller holdings in the capricious Wealth Zoom portfolio. Examples: NIIT Tech stands out as the only negative performer that we’ve held on to, while the high potential Bharat Electronics has delivered a relatively meagre return of just 17% since June last year.

Then there’s McLeod Russel, the world’s largest tea producer, where we are sitting on mouthwatering 63% returns and looking at two straight years of tea shortages if its management’s guesses are any good. Also in Wealth Zoom, our global wind-energy major Suzlon has delivered all of 44%. Should we not be exiting this one, what with slowdowns visible in the American and many European economies?

Some readers have written in saying that the dry-bulk focused Chowgule Steamship has run its full course (56% up since we boarded), and that Idea Cellular (ringing 15% up from our entry price) and Hinduja Ventures (we’ve earned 18% on this in exactly one fortnight of holding) should be pruned, as they don’t look like serious investments. I would normally agree with all the above suggestions and ideas, except for the overarching fact that we are in the middle of some terrific mid-cap action (finally).

|

| Click to see Wealth Zoom portfolio |

This is just the warm-up phase, folks. The ride has just begun. Over the next fortnight, I expect to see the full mania play out. Maybe it’ll last all the way into Budget season, so let’s ride it together. At 62.4% absolute gains in some 28 weeks, Wealth Zoom ain’t broken, mate, so let’s not fix it.

Doing nothing is a perfectly decent strategy in the stock market, especially when one is sitting on decent returns and is on the right side of the momentum. Not all our picks have delivered top-notch returns but that’s to be expected in a portfolio as diversified as Wealth Zoom (20 stocks at last count).

If I do have to tweak things, it might be in our relatively serious Safe Wealth story. You might ask why ICICI Bank (and not State Bank of India or HDFC Bank) is our top-weighted stock. Or whether we should be backing Maruti with the second heaviest bet in the face of aggressive competition in the four wheeler space.

My defence here is that these two companies are the cheapest stocks in their space and size, adjusted for their growth rates. Also riding on the growth theme are the next four stocks in Zoom:

OUR PERFORMANCE SO FAR |

|

*Bharat Heavy Electricals (BHEL) — Growth visible for the next decade, after its recent announcements of capacity increases and consistent order wins at high margins in the face of global competition.

*National Thermal Power Corp (NTPC) — By far the largest and most capable power generator and likely to remain so, notwithstanding Reliance Power’s mind-boggling plans.

*Reliance Industries — No explanation required for backing this one, I guess.

*Reliance Communication — The only serious listed competition for Bharti’s supremacy in the fastest growing telecommunication market of the world.

Which fund manager lost his job buying and holding on to Larsen & Toubro, Tata Steel, Infosys, Hindustan Unilever or Sterlite? Or Britannia, HDFC Bank, Tata Power, Grasim and Areva T&D, for that matter? I can realistically hope for an extension as your fund manager for having invested in these stocks with your long-term funds in the Safe Wealth portfolio.

Instead, my job will come under scrutiny when I decide the exit these long-term picks in my efforts to time the market. I suspect I will get a chance to indulge in this dangerous activity before this year’s Budget.

Till then, and barring some really big unforeseeable developments in the world of investing, let’s ride together. As always, your suggestions and criticisms are welcome at our website, blog or via e-mail.