Have we crossed the top of this bull run? Last fortnight, we were wallowing in midcap momentum, and it's taken just 10 trading sessions for yours truly (and a whole lot of market participants) to raise this nagging question. Global cues are anything but positive. Oil is showing no signs of cooling off and a US Fed rate cut is now being taken for granted. Big US banks have begun to book billions of dollars in subprime write downs, while Europe and the rest of Asia are throwing no positive surprises, while foreign institutional investors sell daily in India.

|

OUR PERFORMANCE SO FAR |

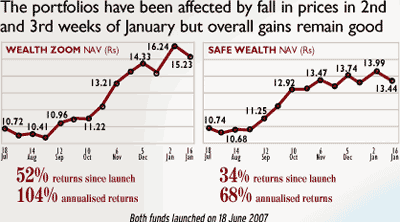

Our portfolios, too, have suffered a setback. Safe Wealth is down to 34.4% absolute gain, while Wealth Zoom is 52.3% in the green. While it is tempting to rue why we did not sell last fortnight, it makes more sense to recognise that we are not in the trading game here. Each one of the companies picked in these portfolios has been chosen because it's a business we want to own a brick in, and not just a ticker price that we want to play.

Meanwhile, the markets are doing what they are best at: trying to scare us out with volatility. As your fund manager, I have only one message for you this fortnight: stay put, and don't lose your cool. This is what the stock market is all about. If you can sanely ride through these rough days without recklessly fiddling with your portfolio, you will (hopefully) emerge richer.

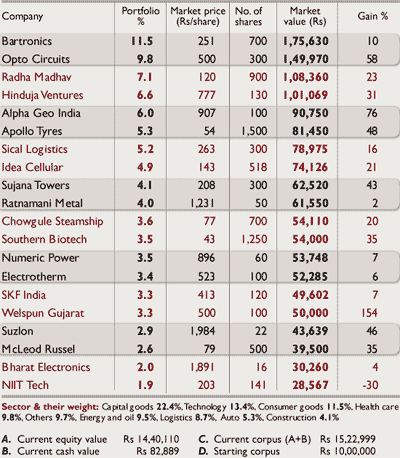

Having said that, we must also do a bit of introspection to see if we can find some attractive businesses (or sectors) that we don't own in Wealth Zoom. This is the portfolio where your fund manager's stockpicking skills should be best displayed. This soul searching will also help me figure out the next few stocks to focus attention on when we hit reasonable appreciation in some of our existing holdings.

If we go by sectors, the most glaring error seems to be the total absence of the financial sector in Wealth Zoom. Considering that Safe Wealth actually has over 15% spread across ICICI and HDFC Bank, financials must find a mention sometime soon in our Zoom portfolio. Potential candidates: Federal Bank, Yes Bank (we've traded this one earlier), Axis and perhaps the cheapest among the public sector pack: Oriental Bank. |

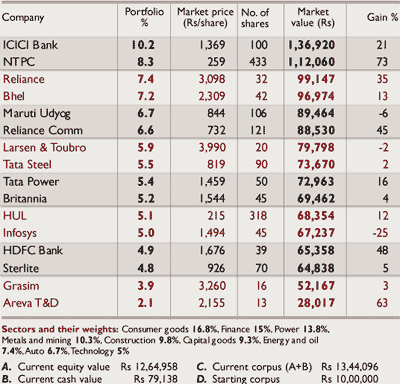

SAFE WEALTH PORTFOLIO |

Given the general view that textiles is a capital-intensive industry with low or cyclical return on investments, I'm happy that this sector does not get a mention in either Zoom or Safe. However, feel free to suggest good investment arguments in favour of Bombay Rayon, JBF, Spentex, Arvind, Raymond and Celebrity Fashions.

Also surprising is the absence of the booming metals sector from Wealth Zoom. And it's funny to see this supposedly cyclical sector at over 10% in Safe Wealth, courtesy our holdings in Tata Steel and Sterlite. From a quality risk perspective, the metals and mining stocks that qualify easily for the Wealth Zoom radar are Sesa Goa, Nalco, Ashapura and, perhaps, Ramsarup.

Wealth Zoom also draws a blank in the hot construction and power sectors. With far fewer stocks, Safe Wealth actually has two members here: Grasim and Larsen & Toubro. Should we add the indefatigable Jaiprakash Associates? I'd think the potential candidates for Zoom in the construction sector include Patel Engineering, HCC and real estate is included in construction, so you might be tempted to suggest Parasvnath, Mahindra Gesco, Omaxe, Purvankara and a littleknown company in Ahmedabad: Ganesh Housing. |

WEALTH ZOOM PORTFOLIO |

For power, Zoom will certainly not be able to find high-pedigree companies like Safe Wealth's NTPC and Tata Power, but it's pertinent to ask whether we should consider Reliance Energy or, better still, Reliance Power at an appropriate price after listing! Navabharat Ventures and Prakash Industries are morphing into mostly power-oriented businesses, and are also eligible in this bracket.

Finally, the one loss-making dud in Wealth Zoom stands out like a sore thumb: NIIT Tech. This is surely among the cheapest of stocks today in the rapidly deteriorating information technology (IT) space, and is down 50% from its 52-week peak. Our only consolation here is that we've lost only 30% on this one. Incidentally, the biggest loser in Safe Wealth also belongs to the IT sector, which tells you exactly how bad the going is for the once-rosy IT space. And it's a stock that has foxed the smartest guys on Dalal Street over most of 2007: Infosys! But we'll leave the introspection on the Safe Wealth portfolio for some other time.

DISCLAIMER: Model portfolios are based on the independent opinion of Dipen Sheth, head of the research team at Wealth Management Advisory Services Ltd. They do not reflect the opinion of the firm. They are for personal reference and information of readers. The firm is not soliciting any action based on the portfolios.