The ELSS Benefit• Highest returns in the past five years • Lowest entry load for any equity-linked product • Greatest flexibility and ease of investment • Tax free profits and dividends |

| Click here to see the graphic |

Forget the volatility in the stocks markets for a minute. Better still, forget it for three years. When you invest in tax planning mutual funds—also known as equity-linked savings schemes (ELSS)—you do exactly that. Investments in these funds cannot be withdrawn before three years so investors need not get bothered by the daily ups and downs of the market.

That’s not such a bad thing. Most probably, when you check your investments three years from now, you would have done fairly well. According to a study, if you remained invested in Sensex shares for any block of three years during the past 27 years, your average annual return would have been 26.95%. The ELSS’ potential to create long-term wealth has not escaped taxpayers’ notice. Ever since Section 80C removed the sub-limit of Rs 10,000 a year on tax saving funds three years ago, the category has grown exponentially.

From 18 funds managing about Rs 900 crore of funds in January 2005, it has grown to 29 tax saving funds managing over Rs 14,500 crore today. The only other tax saving option that has grown at such a scorching pace is insurance. There too, the growth has largely come from Ulips—which is more of a mutual fund than an insurance plan.

And we have not even factored in that ELSS could give substantially higher returns. However, ELSS funds invest in stocks and carry the same risk as any equity fund. The best way to invest in them is in monthly instalments called SIPs. They even out the ups and downs by averaging your cost of purchase over the long term.

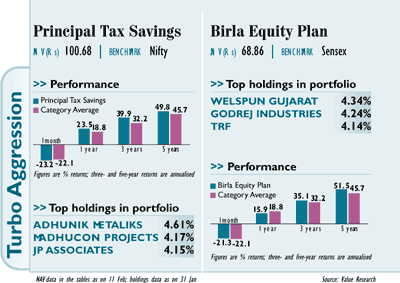

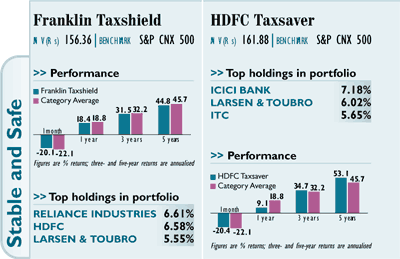

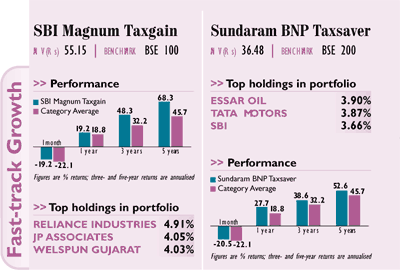

You have even chalked out your mode of investment. Now comes the tricky part—choosing the best fund. Investments in PPF, NSCs or fixed deposits don’t require too much thinking. Only in case of an insurance policy or a pension plan do you need to weigh the choices before you. Ditto for ELSS funds, where your choice of fund is crucial because you can’t rectify the mistake for three years. MONEY TODAY and Value Research zeroed in on the six best tax planning funds for you.