In the case of Suzlon Energy, fund managers bought Rs 1,240 crore worth 50.33 crore shares, taking their total holding in the wind turbine manufacturer to 63.83 crore shares in August

In the case of Suzlon Energy, fund managers bought Rs 1,240 crore worth 50.33 crore shares, taking their total holding in the wind turbine manufacturer to 63.83 crore shares in August

In the case of Suzlon Energy, fund managers bought Rs 1,240 crore worth 50.33 crore shares, taking their total holding in the wind turbine manufacturer to 63.83 crore shares in August

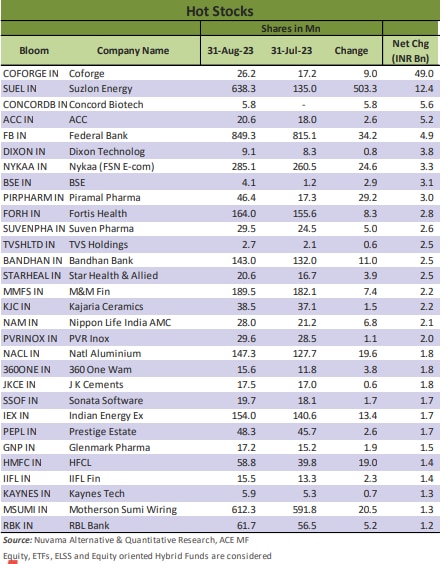

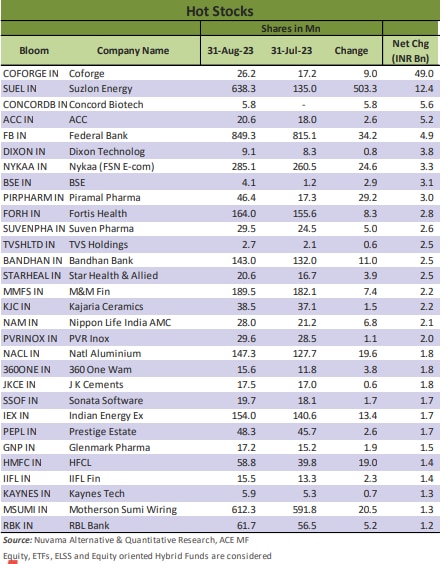

In the case of Suzlon Energy, fund managers bought Rs 1,240 crore worth 50.33 crore shares, taking their total holding in the wind turbine manufacturer to 63.83 crore shares in AugustMidcap stocks such as Coforge, Suzlon Energy Ltd, Federal Bank, ACC and Concord Biotech, among midcap stocks, where mutual funds upped stakes in August. ZEE Entertainment Enterprises, LIC Housing Finance, Escorts Kubota, GMR Airports and Tata Chemicals, on the other hand, were among midcaps where fund managers cut stakes in the month gone by, data compiled by Nuvama Institutional Equities suggest.

In the case of midcap IT firm Coforge, mutual funds bought an additional 90 lakh shares worth Rs 4,900 crore in August. MFs owned 2.62 crore Coforge shares at the end of August against 1.72 crore shares at the end of July.

In the case of Suzlon Energy, fund managers bought Rs 1,240 crore worth 50.33 crore shares, taking their total holding in the wind turbine maker to 63.83 crore shares in August from 13.5 crore shares in July. MFs bought Concord 58 lakh Biotech shares valued at Rs 560 crore in August.

They increased exposure in Adani group cement maker ACC by buying an additional 58 lakh shares, or Rs 560 crore, to 2.06 crore shares in August from 1.8 crore shares in July. Federal Bank was another stock, where MFs upped stakes considerably. MFs bought Rs 490 crore worth 3.42 crore additional Federal Bank shares for the month. Dixon Technologies (Rs 380 crore), FSN E-Commerce Ventures (Rs 330 crore), BSE (Rs 310 crore) and Piramal Pharma (Rs 300 crore) saw significant MF buying in August. Fortis Healthcare, Suven Pharma, TVS Holdings, Bandhan Bank, Star Health, M&M Financial and Kajaria Ceramics also saw strong MF buying for the month.

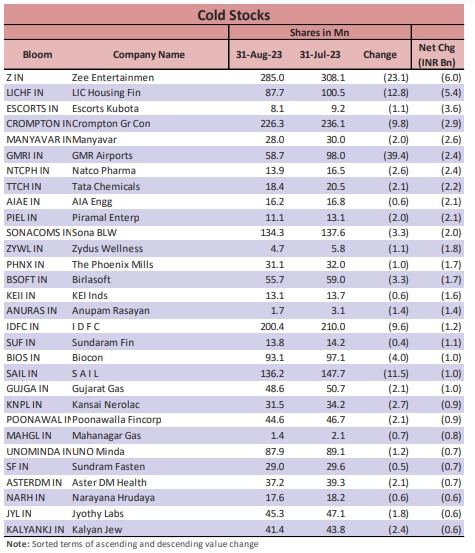

On the flip side, ZEE Entertainment Enterprises saw MFs selling Rs 600 crore worth Rs 2.31 crore shares for the month. MFs managed 28.5 crore ZEE shares at August end against 30.81 crore shares at July end.

Mutual funds sold an additional 1.28 crore shares worth Rs 540 crore in August. MFs owned 8.77 crore LIC Housing shares at the end of August against 10.05 crore shares at the end of July.

In the case of Escorts Kubota, fund managers sold Rs 360 crore worth 11 lakh shares, taking their total holding in the automobile maker to 81 lakh crore shares in August from 92 lakh shares in July. Crompton Greaves (Rs 290 crore), Vedant Fashions (Rs 260 crore), GMR Airports (Rs 240 crore), Natco Pharma (240 crore) and Tata Chemicals (Rs 240 crore) were some other companies seeing fall in MF holdings in August.

Against a 9 per cent rise in the BSE Sensex in 2023 so far, midcap and smallcap indices have rallied 28-31 per cent during the same period. Brokerages such as Kotak Institutional Equities said the primary driver of the rally appears to be irrational exuberance among investors, with high return expectations being driven by the high returns of the past few months. Analysts are a bit cautious on the midcap and smallcap space amid low margin of safety.

Disclaimer: Recommendations provided in this article and/ or any reports attached or relied on herein are authored by an external party. The views expressed herein are those of the respective authors/ entities, and do not represent the views of Business Today (BT). BT does not guarantee, vouch for, endorse any of its contents and hereby disclaims all warranties, express or implied, relating to the same. BT further urges you to consult your financial adviser and seek independent advice regarding the contents herein, including stock investments, mutual funds, general market risks etc.

Also read: L&T, PowerGrid, Jupiter Wagons, HFCL, other stocks to watch on September 12, 2023