At Davos 2026, India’s infrastructure surge meets global caution, but capex bets are rising (Siddharth Zarabi, Group Editor, Business Today,, Dr Bharat Kaushal, MD, Hitachi India Jayadev Galla, Co-founder & Chairman, Amara Raja Group)

At Davos 2026, India’s infrastructure surge meets global caution, but capex bets are rising (Siddharth Zarabi, Group Editor, Business Today,, Dr Bharat Kaushal, MD, Hitachi India Jayadev Galla, Co-founder & Chairman, Amara Raja Group)

At Davos 2026, India’s infrastructure surge meets global caution, but capex bets are rising (Siddharth Zarabi, Group Editor, Business Today,, Dr Bharat Kaushal, MD, Hitachi India Jayadev Galla, Co-founder & Chairman, Amara Raja Group)

At Davos 2026, India’s infrastructure surge meets global caution, but capex bets are rising (Siddharth Zarabi, Group Editor, Business Today,, Dr Bharat Kaushal, MD, Hitachi India Jayadev Galla, Co-founder & Chairman, Amara Raja Group)At the World Economic Forum 2026 in Davos, where packed halls and geopolitical uncertainty defined the mood, India’s infrastructure story stood out, not for grand announcements, but for its scale, visibility and execution focus.

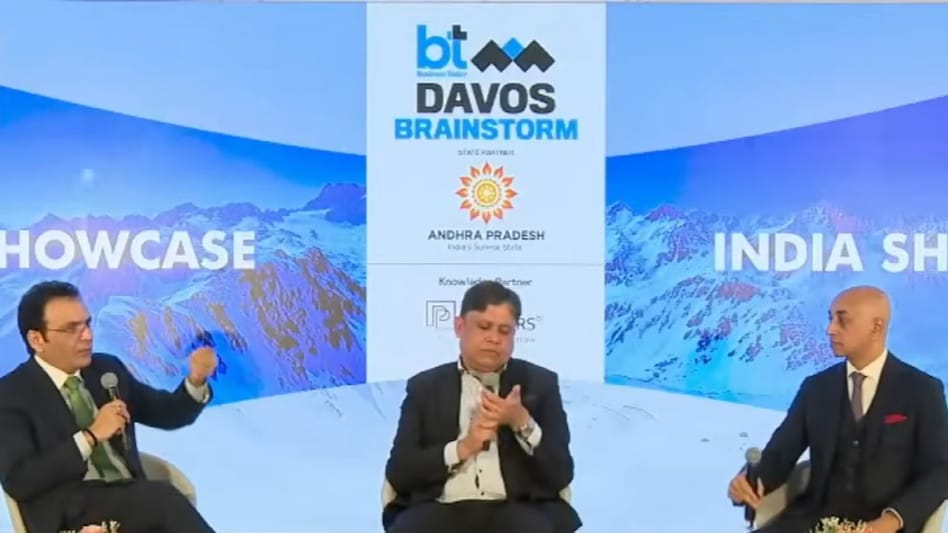

In a conversation moderated by Siddharth Zarabi, Group Editor, Business Today, industry leaders Jayadev Galla, Co-founder & Chairman of Amara Raja Group, and Bharat Kaushal, Executive Chairman, Hitachi India, examined whether India’s infrastructure and real estate push is reaching global scale, and what it will take to turn that momentum into the next growth cycle.

Galla said the broader Davos mood this year was one of hesitation rather than conviction.

“This year, somehow, it felt like I was reading yesterday's news,” he said. “Everybody was kind of hedging their bets, hedging their comments… waiting to see how things are going to unfold before they actually reveal what's on their mind.”

Even US President Donald Trump’s much-anticipated address failed to shift that uncertainty. “There was no more clarity before or after,” Galla noted. “We were expecting some major announcement that didn't really happen.”

Andhra Pradesh’s rise as a credibility signal

Against that global backdrop, India, and particularly Andhra Pradesh, projected confidence.

Galla pointed to Chief Minister Chandrababu Naidu’s long-standing presence at Davos as a credibility anchor for investors.

“Mr Chandrababu Naidu Garu has been coming consistently to Davos for the last three decades… he’s become an expert at how to attract not only visitors to the pavilion, but investors to the state,” he said.

Japan’s patient capital and India’s absorption capacity

From a foreign investor’s lens, Kaushal described India as a rare convergence of scale, patience and readiness.

“There’s been tentativeness in the global economic landscape for at least 5–10 years now,” he said. “But this time, people came with a sense of hunger.”

He traced the shift to India’s ability to absorb capital, which had previously held back Japanese investments.

“In 2022, the two Japanese prime ministers agreed on spending 42 billion dollars in infrastructure by 2025, and most of that money is already spent,” Kaushal said.

Railways are now spending $45–50 billion annually, with the power sector adding another $35–40 billion, a scale that has finally created viable “landing places” for long-term foreign capital.

Data centres, digital infrastructure and the next capex wave

That infrastructure momentum is now spilling into digital assets.

“Just if you look at the 50-odd billion dollars that have been committed for data centre business… that tells you how much the opportunity is,” Kaushal said.

India may lag in industrial AI, he argued, but its digital public infrastructure and domain-specific data make it “the real hotbed of feeding large language models,” allowing data centre investments to deliver outcomes faster than in many other markets.

Growth resilience amid global uncertainty

Galla reinforced the macro argument, noting that India’s GDP forecast has been revised upward even as others are marked down. “In spite of all the challenges… our pace of growth is increasing, not decreasing,” he said.

That resilience, he argued, extends beyond numbers to management culture. “We are very comfortable with operational uncertainties because we face them every day,” Galla said, adding that Indian managers have also learned to navigate strategic uncertainty over the past two decades.

Procurement reform and the quality challenge

As infrastructure and real estate scale up, execution risks remain, especially in public procurement.

“Failures in the government’s PLI scheme is also because of the same L1 mentality,” Galla said. “The qualitative bidding needs to come in more.”

Kaushal acknowledged that change is underway, particularly in capital goods.

“In a weighted average model, price is 50–60%, but the technical specs are also included,” he said, pointing to progress in power and rail projects.