Finance minister Arun Jaitley will present his second full Budget, and the third since the NDA government came to power in May 2014, in the backdrop of a slowing global economy and a domestic financial system that is showing a number of worrying signals. Globally, the other three members of the celebrated BRICs group - China, Russia and Brazil - are battling rising concerns on a number of fronts. Many European countries, too, are struggling with their own set of problems. The US economy has stabilised but is still sometime away from high growth.

Jaitley also has to worry about certain other pressing issues - exports falling month after month, GDP growth not meeting initial expectations, a huge bad loan problem in the balance sheets of government-owned banks and lacklustre domestic investment.

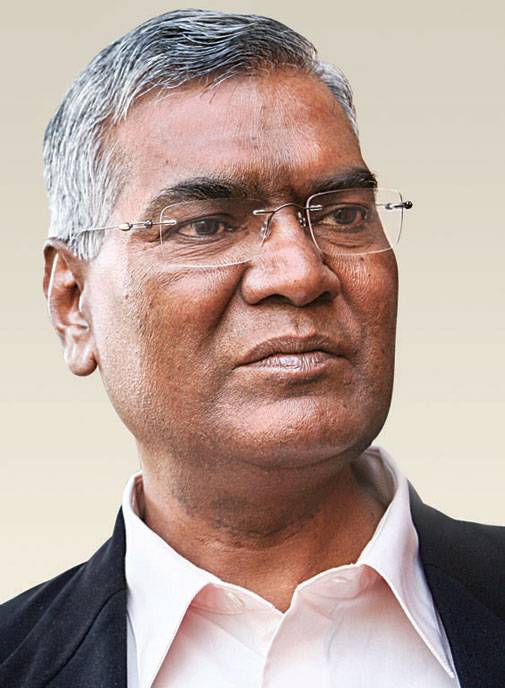

In the run up to the event, six economic and political thinkers joined Business Today Editor Prosenjit Datta to take stock of the country's economic situation and deliberate on the options before the finance minister. The participants of the pre-Budget panel discussion - D. Raja, National Secretary of the Communist Party of India and Member of Parliament; Rajiv Kumar, Senior Fellow, Centre for Policy Research; Abhijit Sen, former head of the department of economics, Jawaharlal Nehru University; Mukesh Butani, Managing Partner, BMR Legal; Harsh Mander, Director of the Centre for Equity Studies; and Sumant Sinha, Chairman and CEO, Renew Power - concluded that the finance minister needs to take bold decisions, but may not have the elbow room to do that. (To access the full panel discussion transcripts and videos, log on to businesstoday.in/prebudget-transcript and businesstoday.in/prebudget-panel) Excerpts:

Prosenjit Datta: Thank you so much for coming to the Business Today Pre-Budget Panel Discussion.

Let me start with the first question. There seems to be a fair amount of gloom and doom, of late, around the Indian economy. The mid-year review scaled down economic growth expectations from 8.5 per cent to 7-7.5 per cent, if I'm not wrong. Consumer inflation has risen, NPAs are up, private investments have not taken off, and globally, also, there seems to be a lot of bad news with a slowing China and problems in Europe. Therefore, I just wanted everyone's opinion, one at a time, on how bad the situation is, or are we overreacting? Should we start with Mr. Raja?

D. Raja: The economy, both globally and at the national level, is in a bad shape. We, the Left, are extremely concerned with the recent developments. We are worried with the creation of wealth and the way this wealth is being distributed in India. Recently, I read the Global Wealth Report, which says that a total wealth of $2.3 trillion (approximately Rs 1,567 lakh crore) was created in the Indian economy between 2000 and 2015.

Prosenjit Datta: Before we come to the question of inclusive growth, do we have growth at all?

Rajiv Kumar: It's a great question. Why should there always be doom and gloom in a country, which is growing at 7.5 per cent? The fact is that our statistics are not reflecting the ground reality. I am not the only one saying this. People in the technical committee for the revision of the GDP series are in agreement with me. I recently heard a very senior official saying that this 7.5 per cent is more like 5 per cent or 5.5 per cent. Therefore, one, there is a need for a clarification on what this new GDP series means in terms of the old numbers, and where we are today in terms of growth. Similarly, if you look at the IIP (Index of Industrial Production) numbers, we have been seeing growth rates of plus-1,000 per cent, minus-400 per cent, or plus-200 per cent, month-on-month, for the same sector. Obviously, this cannot be true. We are in a situation where we are trying to make policy without any reliable statistics or numbers, and instead, shooting in the dark. We must first address this.

Two, ground realities are not very good at all. Manufacturing is in very bad shape - there is 30 per cent more excess capacity. Some sectors, such as steel and textile, which are in a near-comatose state, are scared of (impending) imports, and there are bankruptcies in the offing. This is where our employment should come from. I am in complete agreement with Mr. Raja that the employment situation has worsened in the past 20 months that this government has been in power.

Three, private corporate investments have just refused to grow. It is down by 2.5 per cent or 3.2 per cent. At its peak, it was around 14 per cent. The offtake of credit from commercial banks is growing at 8 per cent, while in 2007 it was 23 per cent. In fact, these factors are creating the feeling of doom and gloom in the economy.

Prosenjit Datta: How bad is the global economy and how is it going to affect us?

Abhijit Sen: The global economy, with the solitary exception of the US, is about as bad as it was in 2008. The only difference with the US is that because of its big numbers, its economy looks much better than it did in 2008. And, that's really the forecast for 2016: the US economy will remain roughly where it is, and there is absolutely no chance that China or Europe, or Japan, are going to do very well. So, on the international economy side, expect a continuation of 2015, which is not a good story.

Rajiv Kumar: The real issue in the global economy is the deficient demand because of the crash in commodity prices. Commodities exporters are now sitting back without any demand. Adding to it is China, whose demand has really come down. That's the reality that faces Indian manufacturers and Indian exporters.

Abhijit Sen: Even if growth slows down there is a lot you could do. It may not be in terms of the economic numbers, which, in any case, have been disputed, but in real terms. As Mr. Raja pointed out, a rapid rate of growth means about 90 per cent of all wealth generated is accruing at the top 10 per cent of the population. The bottom 90 per cent is getting only 10 per cent of that wealth. If we can just push that 10 per cent to 15 per cent, you could actually make a huge improvement in the economic conditions. I see shoots of that political realisation. That is, rather than expecting the economy to rebound as soon as you remove some red tape - the way, I think, this government really thought of the economy when it came to power - the government is now actually looking at areas where there is real deficit, that is, what is witnessed on ground, and some attempt (is being made) to address those. Whether the government will be able to do this is a different thing altogether, because most of this has to be done by the state governments. And, I think, this government has got into a situation where its ability to get the states to do what it would like them to, is hugely diminished partly because of the way the system has changed after the 14th Finance Commission and the end of the Planning Commission. The only reason why 2016 will be better than the previous years is that you've already had two bad monsoons, it is statistically extremely unlikely that we will have another bad monsoon. Statistically, we are likely to have a very good monsoon and that should actually see certain things improve; not just agriculture, but certain other things as well. Whether the government can ride on it, I don't know.

Prosenjit Datta: Mukesh, you have been meeting more corporates than any of us. What is your view?

Mukesh Butani: I see a glass half full. I think there's a lot happening at the ground level to propel growth and attract more investment. We can always sit and debate whether that is good enough - should the government have done more to attract institutional investments, should the government have done more to attract foreign direct investments (FDI), should the government have done more to raise the level of confidence of Indian entrepreneurs, etc. So, the case in point is, as an advisor, I certainly feel that in July and August when the bogey of levying of minimum alternate tax on FIIs came up, they were extremely nervous about it and feared whether the new government was going back on its promises of stability and tax policy.

Prosenjit Datta: I was told by a couple of people that the bankruptcy bill might have even more impact than the GST in the short term. What's your thought?

Mukesh Butani: It is, because it is putting together six important pieces of legislation which were in a complete mess. Whether it is the BIFR (Board for Industrial and Financial Reconstruction) legislation, or provisions under the Companies Act (how you deal with sick companies, the liquidation process or recovery of debt by institutions), it is just not implementable without an integrated bankruptcy code. So, there will be far-reaching impacts and you are not going to see the impact of these legislations in six or nine months, but over a period of time.

I am not an economist, but as far as growth is concerned, my simple philosophy is that growth has to be either demand-driven or policy-driven. The fact is that after 2008 it has been largely policy-driven, whether economic or monetary policies. Sensible policies helped us maintain that edge. For some time we are going to be a policy-led growth economy.

Harsh Mander: I'll just highlight my greatest concerns. The first and most important, is job creation. We need to remember that for every second Indian over the age of 25, a million new young people are joining the workforce every single month. They have dreams and they have aspirations. We have very poor levels of education and we might keep talking about skill development, but they're not ready for the market. On the flip side, the market is also not creating enough jobs.

The second is the complete, almost terminal, crisis that Indian agriculture is in - something we are just not ready to address. It is getting worse and we are in a state of considerable denial. Three years of drought have made things worse. Then comes the issue of food inflation - we are actually getting less and less on the plate for a large segment of our people. The protein content of food is declining substantially. All of this has been aggravated by a climate where we continue to believe in low public spending in the social sector - and is further declining. It has enormous implications because we cannot hope to sustain even the current levels of economic growth, let alone employment, on such an unequal foundation.

Prosenjit Datta: Sumant, what, in your view, is the real economic situation at the moment? You run a business; and a consultancy too. How bad are we?

Sumant Sinha: From the discussions that I had with fellow insiders across the Indian industry, the best feedback is - yes, things seem to have bottomed out, but nobody is really witnessing growth. So, it is a bit of a mystery to me and to a lot of people, as to where this 7.5 per cent of GDP growth is actually coming from.

Prosenjit Datta: What kind of Budget are we likely to get? Is it going to be a bite-the-bullet one or a growth Budget or a populist one? What will you wish for?

Rajiv Kumar: There will be huge focus on agriculture. We will see massive increase (in allocations) in public irrigation systems and more schemes will be announced for the sector. We might see the dismantling of the fertiliser subsidiary regime, which will be wonderful if it happens. The fertiliser subsidies might be directly transferred to the bank accounts of small and marginal farmers, or it could be a system where 5-10 bags are given at a subsidised rate, while everybody else buys it at market price.

Harsh Mander: What would I like to see? There's a lot. But, I fear that we are going to see a business-as-usual Budget. (Despite that), I will just talk about three basic things (that I would have liked to see). The first is the need to address the crisis in agriculture. If the figures are right, anything between 50 per cent and 60 per cent of people are dependent on agriculture or agriculture-related activities, though its contribution to the GDP is less than 15 per cent.

D. Raja: I don't expect great things from the Budget. The government will be increasingly under the influence of corporate houses. Whether it is the BJP or Congress, governments should act as a welfare state. The working people are the primary productive force in any economy. Unless they are involved or their purchasing capacity is increased, demand will not increase. You ask the poor to tighten the belt, but you loosen everything for corporate houses and the rich. That is why the economy is getting into a very bad state. I do not know whether Mr. Arun Jaitley will address some of these issues rationally and realistically. If he is moved by his own philosophy or by his own ideology, or he is influenced by other vested interests, then I do not think we are heading for a bright future.

Abhijit Sen: I think Rajiv hit it right on the head. It is going to be a Budget that will have, as lots and lots of budgets in the past have had, probably slightly longer spiel on agriculture and what the government intends to do about it.

I think there is a problem that people don't realise. In the coming years, the Union Budget is going to be even less important because of the devolution of taxes from the Central government to the state governments. One of the reasons why nothing much can be done about health and education is because the Centre, which has other priorities, can rightly pretend that this is something they can't do anything about, because the money has already been given to the sates on health and education. Unfortunately, exactly the same thing applies to agriculture, which is also a state subject. The simple point that I am trying to make is that we need to look a bit more at the state budgets and not so much at the Union Budget.

Mukesh Butani: I think the Finance Minister will stick to his commitment of bringing down corporate tax rates. I did hear comments about the Budget being pro-business; India is perceived as a low taxed country, but what is the tax base of India? Let me just put certain things in perspective. India is a very high taxed country, it is not a low taxed country if you look at the impact of the corporate tax rate or dividend distribution tax. It also has a very inefficient tax administration, which pushes up cost of compliances to businesses and, hence, it is imperative for the government to bring down the tax rates. Of course you know the debate that others have been having. Who is responsible? Is it the Central government, the state governments, the private enterprise, or the civil society? I think everybody has to play a role in the growth of an economy - state governments, Central government and businesses. If you are not going to encourage businesses, private sector investment is not going to happen. If you are not going to have private sector investments, you are not going to create jobs. So, it is a vicious circle. If you look at the average rates of the Organisation for Economic Cooperation and Development (OECD) and non-OECD countries, India is a high tax country. I think we have an extremely inefficient administration, which pushes up our compliance costs. So, reduction of corporate tax in my view is given.

Sumant Sinha: I think that the focus of the Budget is probably going to be in two areas. One is infrastructure, where a lot can actually be done, whether it is in the area of affordable housing or airports or more roads, or even building other transmission grids, besides many others. There are lots of areas, where we can actually spend more money, and now that the ministers have been there for a year and a half, two years, they should have the ability to know the areas (where more spending is necessary) and how to get the money spent in the most productive manner. That probably is an area that is going to see some increase in spending. The FM has talked about decreasing tax rates and, at the same time, removing exemptions. So, I don't know what the final outcome is going to be. Actual tax rates may go up for certain types of corporates and, perhaps, it will be lower for certain others. But we have to see exactly how that whole thing shapes up. I think the answer to the tax issue is that individuals in India are certainly not paying enough taxes. I think corporates are paying fairly reasonable amount of taxes from a global stand point. If you just increase tax rates, it is going to further depress investments and they are going to further depress foreign direct investment. There is no benefit in doing that. Therefore, we have got to look at taxing potential individuals more because, as everybody has already opined, our tax net is very narrow. That's the area the central government must look at.