Old Bridge Capital Management Founder Kenneth Andrade says excesses in the small and microcap space raise concerns and there is an anticipation of volatility

Old Bridge Capital Management Founder Kenneth Andrade says excesses in the small and microcap space raise concerns and there is an anticipation of volatility

Old Bridge Capital Management Founder Kenneth Andrade says excesses in the small and microcap space raise concerns and there is an anticipation of volatility

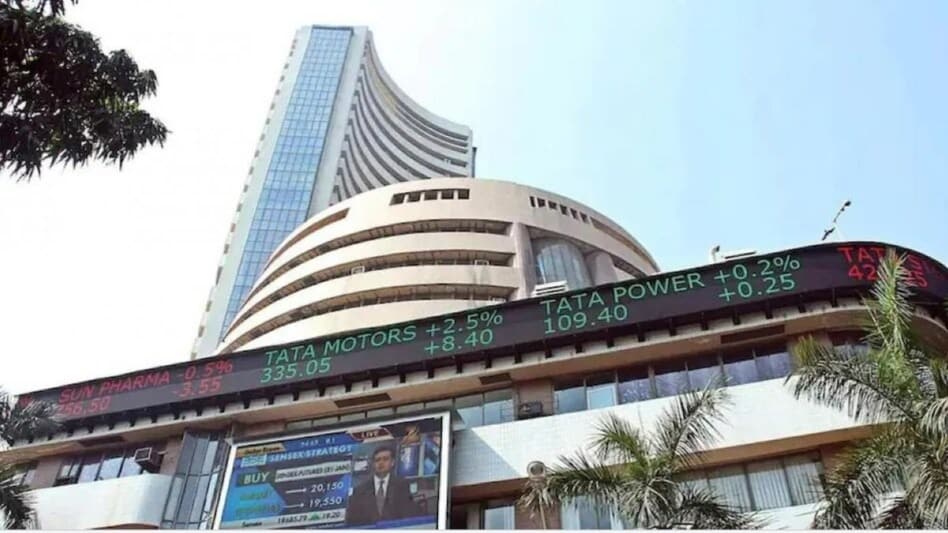

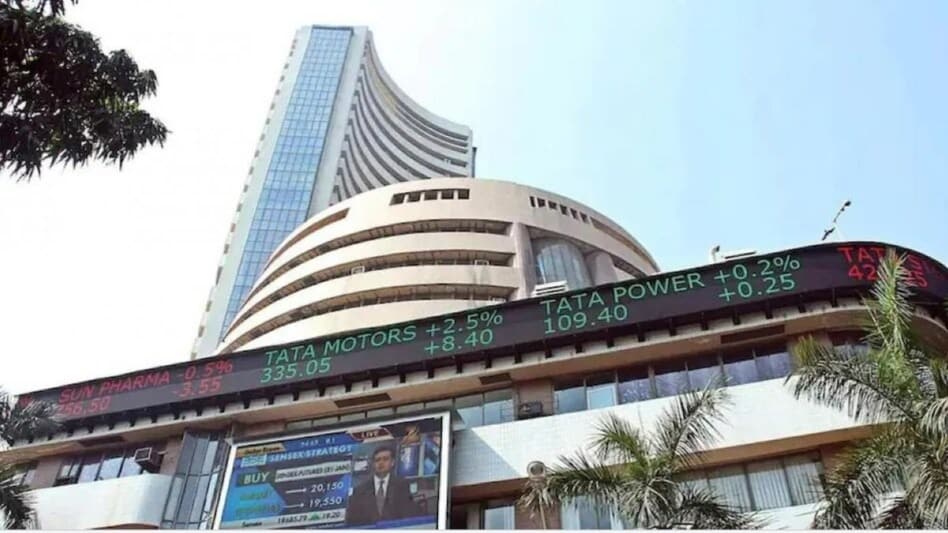

Old Bridge Capital Management Founder Kenneth Andrade says excesses in the small and microcap space raise concerns and there is an anticipation of volatilityThe market capitalisation to GDP ratio (also known as the Buffett indicator) has reached levels that signal potential overvaluation and suggests that investors should tread with caution as the market may have priced itself well ahead of the curve, according to Kenneth Andrade, Founder, Director-Old Bridge Capital Management and CIO-Old Bridge Asset Management. The ratio measures the total value of all publicly traded stocks in a country, divided by that country’s gross domestic product (GDP).

Andrade shared these views on December 20 even as the benchmark equity index BSE Sensex crashed nearly 931 points, or 1.30 per cent, to 70,506. On a year-to-date basis, the 30-share index has gained more than 15 per cent in 2023. On the other hand, broader indices including the BSE MidCap and BSE SmallCap indices have soared over 40 per cent each YTD.

“The Indian equity markets in 2023 have experienced significant growth, marked by record high collections in the mutual fund (MF) industry reflecting a robust participation of domestic investors. Simultaneously, the primary market has been vibrant, and foreign institutional investors (FIIs) are showing increased interest, indicating a strong sense of confidence in the Indian market,” the market watcher said.

He added that there is a noticeable disparity in investor preferences, with domestic investors favouring smaller names, while international investors lean towards larger and indexed weights. Mega caps are now gaining traction as valuations align in their favour.

Meanwhile, the financials of corporate India present a positive narrative. “Corporate balance sheets are witnessing an all-time low in leverage, providing companies with an opportunity to invest in growth and market gains using their own robust cash flows. The stability in macroeconomic and political factors coupled with government capital expenditure, further enhances the conducive environment for business,” Andrade said.

He advised investors to stay cautious in 2024. Andrade believes that excesses in the small and microcap space raise concerns and there is an anticipation of volatility, especially in segments where valuations appear stiff.

“Despite these short-term challenges, the overarching trend seems to favour India, presenting a higher growth potential relative to peer countries in the region. As we navigate the landscape of India’s equity markets, the resilience displayed by corporate India and the strategic opportunities in both manufacturing and services sectors are encouraging. Caution is advised in certain segments due to potential overvaluation; the fundamentals remain robust,” Andrade said.