Budget 2026 Tax

Budget 2026 Tax

Budget 2026 Tax

Budget 2026 TaxIncome tax: Even though Finance Minister Nirmala Sitharaman left income tax slabs unchanged in the Union Budget 2026, salaried taxpayers still have significant headroom to cut their tax bills, potentially to zero, under the New Tax Regime in FY2026-27. While income up to Rs 12 lakh continues to be tax-free due to the enhanced rebate under Section 87A, salaried individuals can extend this threshold well beyond that level with careful salary structuring.

According to CA Parag Jain, Tax Head at 1 Finance, salaried employees can legally pay zero income tax on salaries of up to Rs 14.65–14.66 lakh by optimising employer contributions to retirement schemes such as the Employees’ Provident Fund (EPF) and the National Pension System (NPS). The benefit arises from a combination of the standard deduction and exemptions or deductions available on certain employer-funded contributions under the new tax regime.

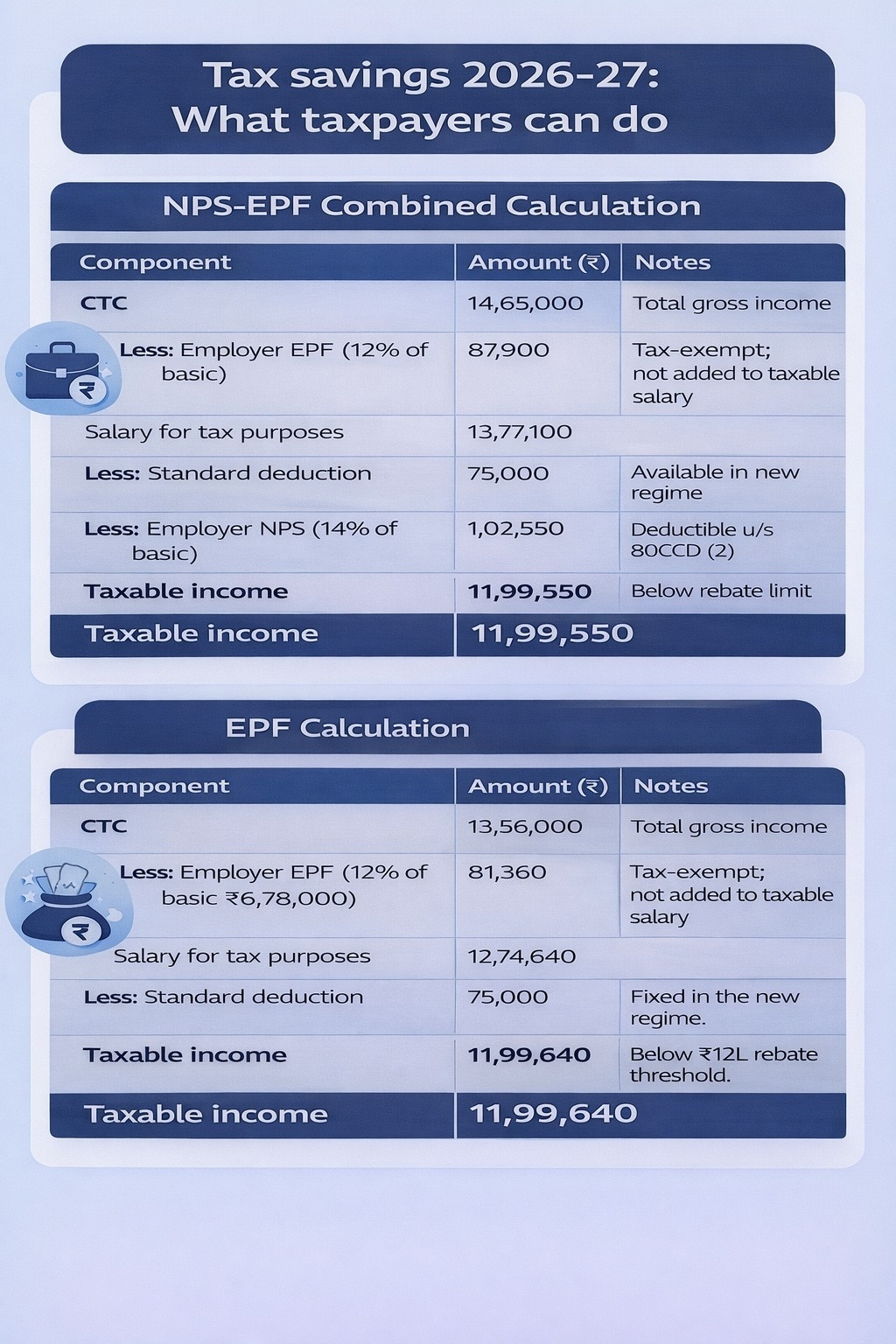

Tax saving calculations

Under the new tax regime applicable for FY 2026–27, salaried taxpayers are eligible for a standard deduction of Rs 75,000. In addition, employer contributions to EPF and NPS, within prescribed limits, are either excluded from taxable salary or allowed as deductions. If these components are structured efficiently, taxable income can be brought down to Rs 12 lakh or below, making the taxpayer eligible for a rebate of up to Rs 60,000 under Section 87A, which effectively wipes out the entire tax liability.

Jain explained that the highest tax-free salary threshold is achievable only when both EPF and NPS are part of the compensation structure. “If an employee opts for both EPF and NPS, and the basic salary is structured at around 50% of CTC, a total salary of about Rs 14.65 lakh can be made tax-free,” he said.

Combining EPF and NPS

For example, with a basic salary of Rs 7.32 lakh, the employer’s EPF contribution at 12% works out to about Rs 87,900, which is not added to taxable income. From the remaining salary, the standard deduction of Rs 75,000 is applied. In addition, the employer’s NPS contribution—up to 14% of basic salary, or roughly Rs 1.02 lakh—is deductible under Section 80CCD(2). This brings taxable income to just under Rs 12 lakh, allowing the Section 87A rebate to eliminate tax.

Importantly, the combined annual cap of Rs 7.5 lakh on employer contributions across EPF, NPS and superannuation funds is not breached in this structure, as total employer contributions remain well within the limit.

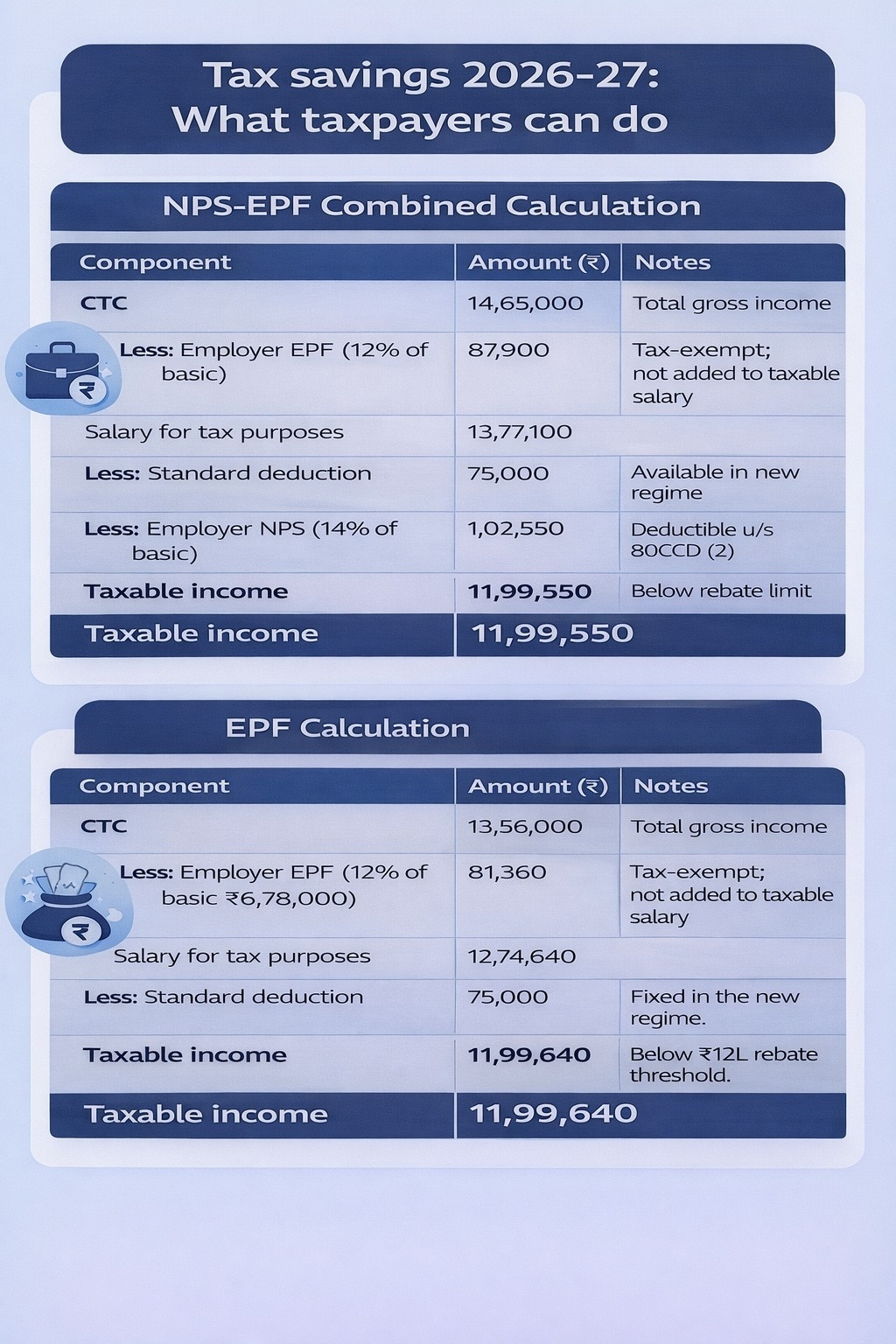

Access only to EPF

However, Jain noted that if an employee has access only to EPF and not NPS, the tax-free salary ceiling reduces. In such cases, the maximum CTC that can remain tax-free under the new regime is about Rs 13.56 lakh. With a basic salary of roughly Rs 6.78 lakh, the employer’s EPF contribution of about Rs 81,360 is exempt. After applying the standard deduction, taxable income again falls just below Rs 12 lakh, making the taxpayer eligible for the full rebate under Section 87A. While this structure still results in zero tax, the absence of employer NPS contribution lowers the overall tax-free salary potential.

There are several limits that salaried individuals should keep in mind. Employer EPF contributions are exempt only up to 12% of basic salary plus dearness allowance. Employer NPS contributions are deductible up to 14% of basic salary for private-sector employees in FY 2025–26. The combined ceiling of Rs 7.5 lakh per year applies across EPF, NPS and superannuation contributions. Notably, employee contributions do not qualify for deductions under the new regime.

Experts caution that achieving these outcomes depends heavily on salary structuring and employer participation. Employees should review their CTC structure in consultation with their employer to ensure compliance with tax and provident fund rules. With careful planning, the new tax regime can still offer significant tax efficiency, particularly for salaried individuals with access to both EPF and NPS through their employer.