HDFC Mutual Fund remains at top of equity funds: PRIME Database

HDFC, which also has the biggest market share of 16 per cent of the

total Rs.1.85 lakh crore of equity mutual funds AUM, is followed by UTI

with Rs. 22,906 crore of AUM and 12 per cent of market share. Next in

the list are ICICI Prudential at Rs.19,969 crore (11 per cent) and

Reliance at Rs.18,414 crore (10 per cent).

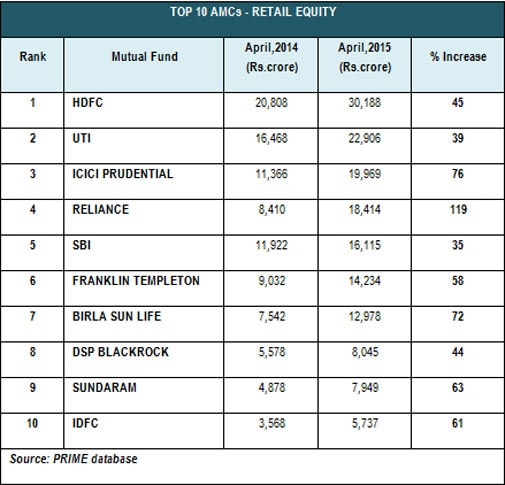

HDFC Mutual Fund continued to top the chart for retail equity mutual funds with a 45 per cent rise in assets under management to Rs 30,188 crore (AUM) as on April 30 2015, according to a PRIME database report.

HDFC, which also has the biggest market share of 16 per cent of the total Rs.1.85 lakh crore of equity mutual funds AUM, is followed by UTI with Rs. 22,906 crore of AUM and 12 per cent of market share. Next in the list are ICICI Prudential at Rs.19,969 crore (11 per cent) and Reliance at Rs.18,414 crore (10 per cent).

Reliance mutual fund is catching up fast with the top players, having seen its AUM rise 119 per cent from Rs.8,410 crore in April 2014 to Rs.18,414 crore in April 2015. Equity funds continued to dominate the retail mutual fund wallet by increasing its share from 67 per cent in April 2014 to 74 per cent in April 2015.

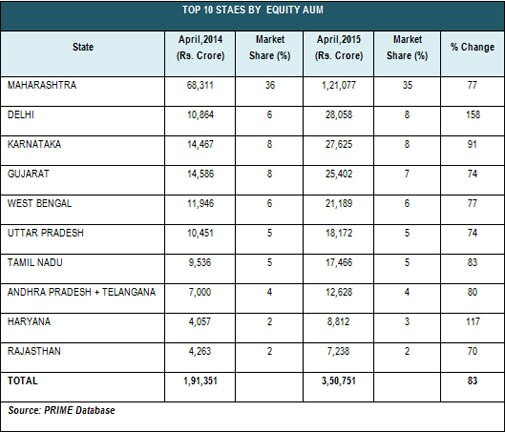

If we look at the state-wise equity AUM across all investor classes, Maharashtra is way ahead at Rs.1.21 lakh crore with 35 per cent of share. It is followed by Delhi with Rs. 28,058 crore AUM, a rise of 158 per cent over the last year. Various other smaller states such as Haryana, Jharkhand and Uttaranchal also more than doubled their equity AUM from last year.

Disclaimer: Business Today provides market and personal news for informational purposes only and should not be construed as investment advice. All mutual fund investments are subject to market risks. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions.

Published on: Jun 2, 2015 10:30 PM IST