Tax experts advise keeping gift receipts, transfer proofs, and relationship documentation — especially for high-value gifts.

Tax experts advise keeping gift receipts, transfer proofs, and relationship documentation — especially for high-value gifts.

Tax experts advise keeping gift receipts, transfer proofs, and relationship documentation — especially for high-value gifts.

Tax experts advise keeping gift receipts, transfer proofs, and relationship documentation — especially for high-value gifts. As the festival of lights fills homes with joy, sweets, and gifts, the tax department has a reminder — your Diwali gifts might come with a tax bill. According to income tax laws, the taxability of gifts depends on who gives them and their total value during a financial year. While gifts from close relatives are tax-free, those from employers or non-relatives may attract tax under the head “Income from Other Sources.”

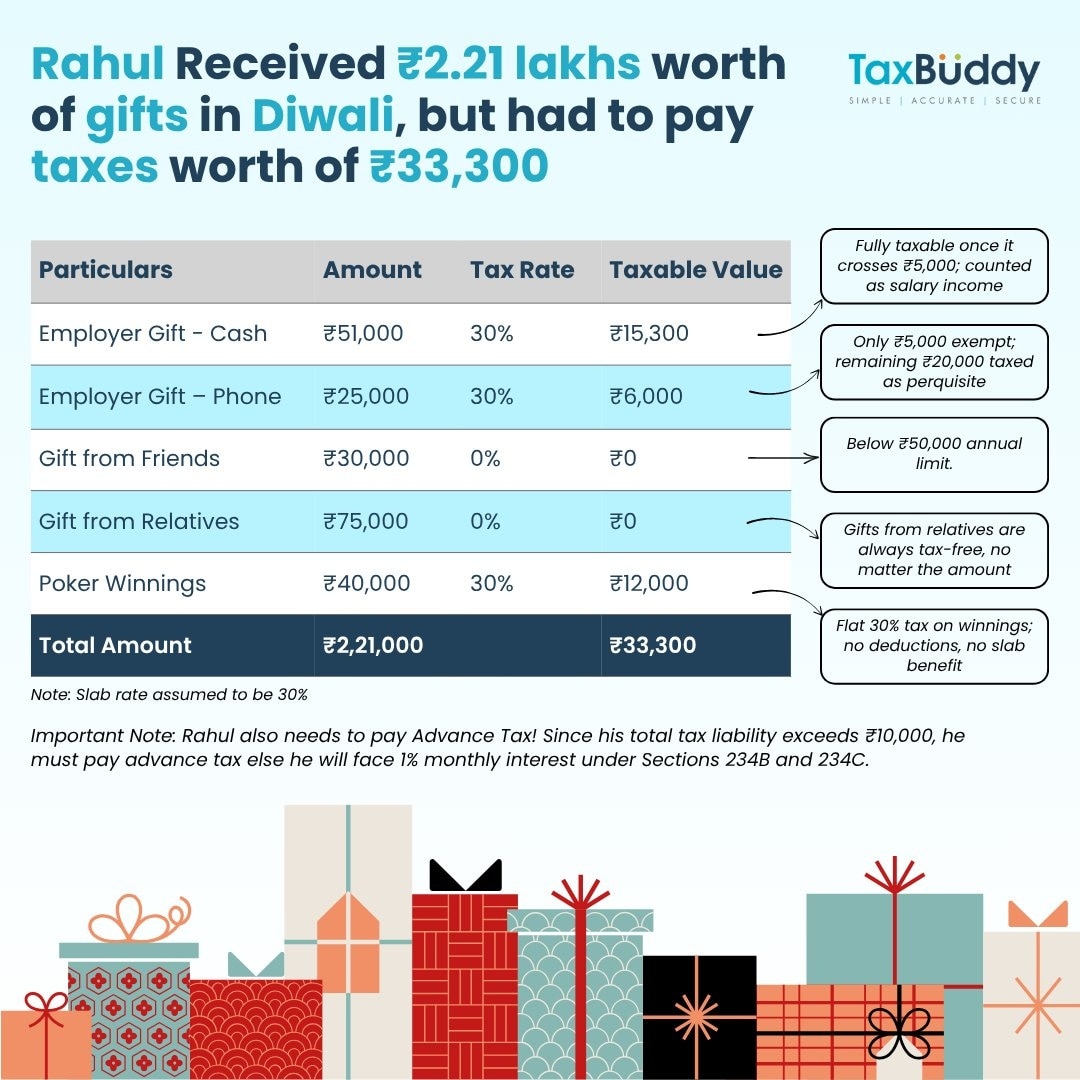

Tax advisory platform TaxBuddy.com recently shared a real-life example that went viral online. Their client, Rahul, received Diwali gifts worth Rs 2.21 lakh this year from his employer, family, and friends. What he thought was a cheerful celebration turned into a surprise when his chartered accountant told him he owed Rs 33,300 in taxes — and possibly interest for delayed advance tax payment.

How Rahul’s Diwali gifts were taxed

TaxBuddy broke down Rahul’s case to show how different types of gifts are treated under Indian tax law:

1. Employer Gift (Cash): Rahul’s employer gave him a Rs 51,000 cash bonus. Any cash gift from an employer is fully taxable as salary, with no exemption beyond Rs 5,000.

Tax @30% = Rs 15,300

2. Employer Gift (Phone): Rahul also received a smartphone worth Rs 25,000. Gifts in kind from employers are tax-free only up to Rs 5,000 per year. The remaining Rs 20,000 was taxable as a perquisite.

Tax @30% = ₹6,000

3. Gift from friends: He received Rs 30,000 in cash from friends. Gifts from non-relatives are tax-exempt up to Rs 50,000 in total per year. Since Rahul’s total from friends was below the limit, no tax applied.

Tax = Nil

4. Gift from relatives: Rahul’s family gifted him Rs 75,000, which was completely tax-free, as gifts from specified relatives (parents, spouse, siblings, children, or lineal ascendants/descendants) are fully exempt, regardless of amount.

5. Poker Winnings: Rahul also won Rs 40,000 in an online poker game. Such winnings are taxed at a flat 30%, with no deductions.

Tax = Rs 12,000

Total Gifts: Rs 2.21 lakh

Taxable Portion: Rs 60,000

Total Tax: Rs 33,300 (at 30%)

The hidden surprise

TaxBuddy’s advisory didn’t end there. Rahul also needed to pay advance tax, since his total liability exceeded ₹10,000 for the year. Advance tax must be paid in instalments:

15 June – 15% of total tax

15 September – 45%

15 December – 75%

15 March – 100%

If Rahul fails to pay, he’ll face 1% monthly interest under Sections 234B and 234C until the tax is cleared.

Gift tax rules

Gifts from Relatives: Fully tax-exempt, regardless of value. Relatives include your spouse, parents, children, siblings, and their spouses.

Gifts from Non-Relatives: Tax-free up to Rs 50,000 in aggregate per financial year. Beyond that, the entire amount becomes taxable.

Gifts from Employers: Non-cash gifts (like gadgets or vouchers) are exempt up to Rs 5,000 annually.

Cash gifts or bonuses are fully taxable as salary.

GST angle: Employers giving gifts above Rs 50,000 per employee per year must pay GST on those items. However, cash gifts are not subject to GST.

Keep records, stay compliant

Tax experts advise keeping gift receipts, transfer proofs, and relationship documentation — especially for high-value gifts. All taxable gifts must be declared in your Income Tax Return under “Income from Other Sources.”

TaxBuddy summed it up perfectly: “Festive generosity is welcome, but the taxman doesn’t celebrate exemptions lightly.” For millions of Indians exchanging Diwali gifts, it’s a timely reminder — even your celebrations need tax planning.