Team India's terrific performance in the recently-concluded cricket World Cup in Australia had a few consistent themes. The bowling was brilliant, the fielding much-improved and the planning and execution came good on most occasions. Whenever India batted, they started cautiously but steadily and built a solid foundation in the first 15 overs till they became sure of the conditions and the competition. It was a case of going back to the basics as the stakes grew higher. This was the hallmark of most of India's matches; the only exception being the heart-breaking semi final where they went all out initially and eventually got all out too soon.

India Inc. seems to have taken a few points from the World Cup script when it comes to pacing their own innings, which started around the same time the mega event kicked off. They seem to have resisted the temptations offered by a good batting pitch and conducive match conditions: they did not flirt too much with danger or commit themselves too early. Not that there is a need for it: there is a stable government at the centre, the rupee is getting stronger, the GDP is expected to improve, inflation is in control and there is general euphoria in the market. And in the past, these signs would have triggered off a frenzy of activity around salary increments and people movement. Not this time around.

The survey highlighted that almost 70 per cent of the respondents believe that there will be an improvement in the business outlook. Naturally, with changing sentiments, employee expectations have also gone up manifold. However, organisations are managing these higher expectations carefully and not getting swayed by sentiment alone. Although almost 83 per cent of the respondents have increased the compensation budget, the focus on performance differentiation is far higher, with a larger proportion of budgets being allocated to higher performers. Data this year shows that across the board, top performers are expected to get 1.6 times the salary increase awarded to average performers.

The Sector Story

The Match Winners who Matter

Pay for performance is not a cliched jargon anymore. Over the years, India Inc. has moved from a socialistic view with limited differentiation based on performance to a stage, where organisations have rigorously followed the bell curve principles. India Inc's performance distribution curve today is very different from what it was earlier. Employee distribution has become significantly sharper since 2007. Almost 68 per cent of the population falls under the 'Meets expectation and below' category. This proportion has increased by about 20 per cent since 2012. In the last five years, the percentage of employees with top performance rating has dropped by close to 30 per cent, implying that organisations are not hesitating to differentiate sharply on the basis of performance and are allocating the share of the total increase budget accordingly.

Is the Divide Increasing?

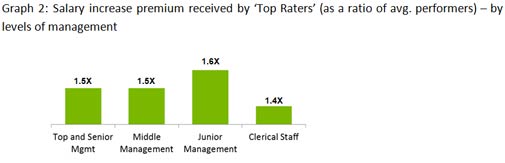

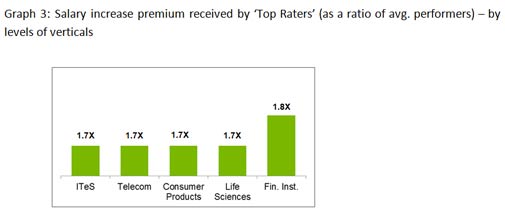

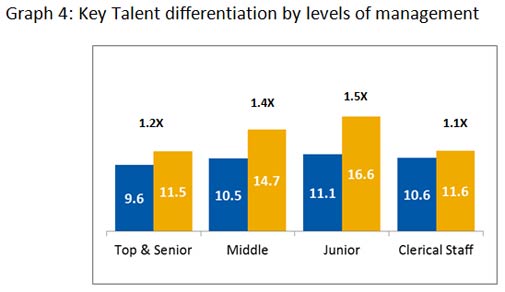

Top performers in India will get almost 1.6 times of what their colleagues will get. Among all industries, Financial Institutions are giving out the highest differentiation at 1.8 times. Life Sciences, Consumer Product, Telecom and ITeS are a close second at 1.7 times. While Financial Institutions have historically led the pack, it is interesting to note that industries like Life Sciences are making the cut as top differentiators. Other industries like Telecom and Consumer products have continued rewarding high performance. Junior management is gaining the most due to this stark differentiation. At this level, the top performers receive almost 1.6 times whereas the top and middle management gets about 1.5 times.

Key Talent Differentiation

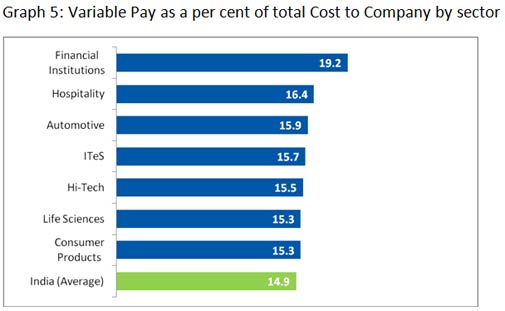

With the growing maturity of an economy, the acceptance of pay at risk increases. India Inc. has at large moved to a 'Pay at Risk' concept. Across industries, organisations are offering variable forms of pay at risk - annual variable pay, sales incentive or long-term incentive. The survey revealed that in 2014, 86 per cent of the organisations reported making a bonus payout. In fact approximately 11 per cent organisations speak of transferring salary increases from fixed pay to variable pay.

There is a steady trend towards greater performance-based pay and it indicates a shift in overall pay philosophy across Indian companies. Almost 15 per cent of total compensation is formed through pay at risk. At the top and senior management a quarter of the total compensation comes through this. This number is close to 12 per cent at the junior management level.

Long-term incentives (LTI) are increasingly becoming popular. LTI vehicles like ESOPs, which were historically provided only at senior levels, have seen an increased prevalence across all levels of management across industries. Specifically in the technology sector, the rising number of e-commerce firms and startups with niche solutions and technologies are relying on LTI to incentivise, as well as retain, employees and grow with the firm. Financial Institutions, Hi-tech and FMCG firms are the leaders in payouts through long-term incentives.

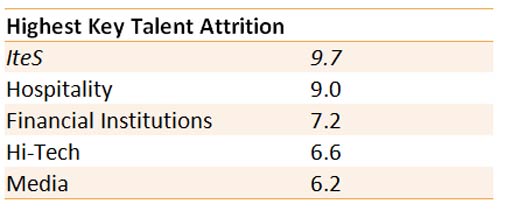

The Case of Attrition

It is interesting to note that the key talent attrition has moved up. In 2014, it was at 5.9 per cent vs 4.5 per cent in 2013. While organisations have not jumped at the positive sentiments in the market and have not gone all out on hiring, they have definitely started looking out for better talent available in the market.

The services industry has been hit hardest by this phenomenon, particularly the ITeS and Hospitality sectors that have key talent attrition in the 9 per cent-plus category, which is a big concern. Manufacturing firms on the contrary continue to keep their key talent attrition at bay.

Time for Total Rewards?

While salary-linked benefits are mandatory, firms are designing bespoke benefits plans to meet the separate needs of Gen X, Y and Z. Therefore, flex-ben has been taken up quite seriously by many firms. The number of people availing these benefits has also seen an increase from the years before. Benefits have been identified as one of the key retention measures apart from compensation.

The match is yet to be won

We believe that industry's response to the economic sentiment and reform-led growth outlook has been sustained, steady and systematic. This augurs well for a country that is increasingly bringing in maturity in its orientation towards rewards, retention and performance differentiation. It also makes sense as some organisations believe that the positive business sentiment and market buoyancy is yet to take shape in the form of a spurt in actual business - most believe this to become a reality in the next six to eight months. And even if the evidence of a strong economic upturn emerges sharp and clear, India Inc. would do well to keep humility and prudence at the forefront of its rewards strategy, and be mindful of the scars that previous extravagances have left. Team India may have bowed out of the World Cup, but India Inc. needs to maintain the focus and the mindset to win the long-term battle of people and profitability as good days start to shine, sooner than later.

Authors

Sagorika Roy is Manager and Roopank Chaudhary is Associate Partner at McLagan, an Aon company.