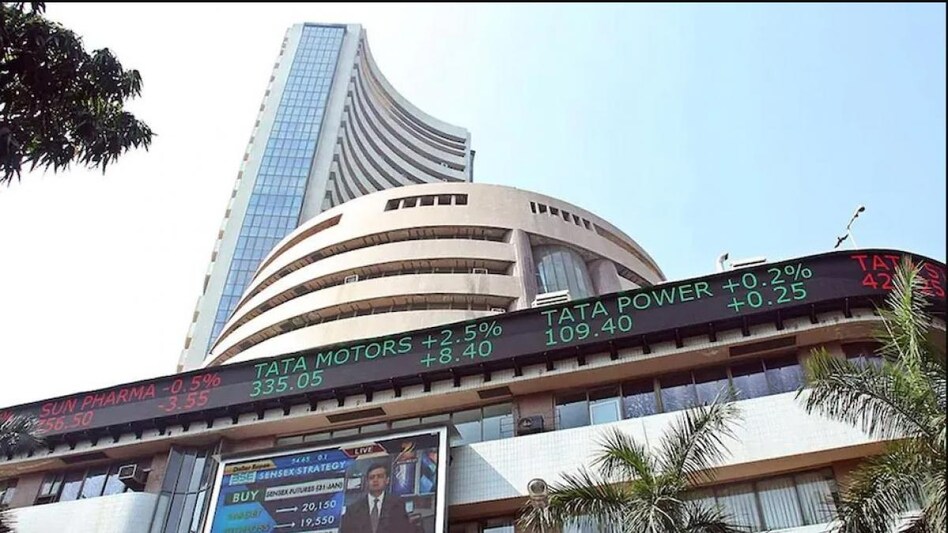

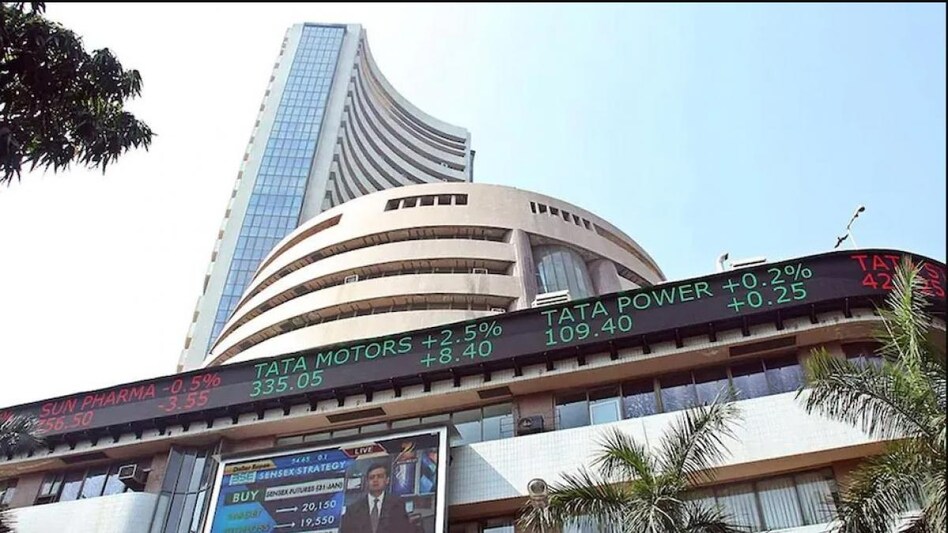

Share Market Live: Tracking Sensex, Nifty today

Share Market Live: Tracking Sensex, Nifty today

Share Market Live: Tracking Sensex, Nifty today

Share Market Live: Tracking Sensex, Nifty todayStock Market LIVE Updates Today: The Indian market ended lower today. Sensex fell 652 pts to 59,646 and Nifty lost 198 pts to 17,758. Sensex closed above the 60K mark for the second consecutive session on Thursday despite negative global cues. Sensex climbed 37.87 points to 60,298 and Nifty gained 12 points to 17,956. Bajaj twins, Bharti Airtel and Tech Mahindra were the top Sensex gainers, rising up to 5.74 per cent. Dr Reddy's, Wipro, Infosys and M&M were the top Sensex losers, falling up to 2.18 per cent.

Bulls vs Bears: Here's what to expect on Dalal Street today

Here's a look at live market updates today.

3:30 pm: Closing update

The Indian market ended lower today. Sensex fell 652 pts to 59,646 and Nifty lost 198 pts to 17,758.

1:34 pm: Market Update

Sensex falls 583 points to 59,714 and Nifty loses 191 points to 17,764 in the afternoon session.

12:49 pm: Adani Wilmar shares rise 4% in volatile trade, what's behind the rally?

Shares of Adani Wilmar rose 4 per cent amid volatile trade today as the stock was one of the probable inclusions in Nifty Next 50 index. Adani Wilmar stock gained 4.09 per cent intraday to Rs 761.55 against the previous close of Rs 731.65 on BSE. Adani Wilmar shares also touched an intraday low of Rs 731.50 on BSE. A total of 7.98 lakh shares of the firm changed hands amounting to a turnover of Rs 59.66 crore on BSE. Market cap of the firm rose to Rs 96,501 crore on BSE.

The share hit a high of Rs 878.35 on April 28, 2022. Considering the current market price, the stock has lost 13.29 per cent till date.

11:41 am: Market update

Sensex falls 484 pts to 59,813 and Nifty loses 152 points to 17,803.

11:23 am: Market update

Sensex falls 253 pts to 60,044 and Nifty loses 95 points to 17,841.

10:51 am: Talbros Engineering shares rise 7% in volatile market, here's why

Shares of Talbros Engineering gained 7 per cent amid a volatile market today after the company said it has started construction on land acquired for setting up of new production unit in Faridabad. Talbros Engineering stock touched an intraday high of Rs 609.95, rising 7.07 per cent on BSE.

Earlier, the stock opened higher at Rs 570.65 today against the previous close of Rs 569.65. The share has gained 146.83 per cent in one year and risen 104. 08 per cent since the beginning of this year. In a month, the share has climbed 57.85 per cent.

Total 8,290 shares of the bank changed hands amounting to a turnover of Rs 49.24 lakh on BSE. Market cap of the firm rose to Rs 304.08 crore.

Talbros Engineering shares hit a 52-week high of Rs 624 on August 18,2022 and a 52-week low of Rs 202.30 on October 29, 2021.

10:00 am: Windfall profit tax hiked on export of diesel, cut on domestic crude oil

The government hiked the windfall profit tax on Thursday on the export of diesel to Rs 7 per litre, but slashed the levy on domestically produced crude oil. The government also brought back a tax on jet fuel exports.

The windfall profit tax was increased to Rs 7 per litre from Rs 5 per litre on the export of diesel. The government also brought a Rs 2 per litre tax on ATF exports in the fortnightly review, the Ministry of Finance said in a notification.

This comes after the government scrapped windfall profit tax on ATF earlier this month.

Tax on domestically produced crude oil has been cut to Rs 13,000 per tonne from Rs 17,750 per tonne.

9:21 am: Market update

60,047

9:15 am: EXPERT TAKE

Tirthankar Das, Technical & Derivative Analyst, Retail, Ashika Stock Broking

"On the technical front, Nifty formed a small positive candle on the daily chart and is close to challenge the life time high. The trendline resistance adjoining the highs of Oct'21, Jan'22 and Apr'22 has been breached and is trading comfortably above it. Against such backdrop one can expect that the present rally to extend further immediately towards 18100-18150 levels. Likewise support base has now shifted higher to 17,500 to 17,550 range (gap support). Momentum oscillator though are trading in overbought price conditions, but no signs of exhaustion can be seen yet rather had been supportive with weekly RSI breached past the 6-months falling trend line. Market breadth has seen remarkable improvement, indicating broader market participation across sectors. Thus, during the day Nifty is likely to open on a slight negative note, however overall outlook is positive hence, intraday dip towards 17,800-17,850 can be the buying opportunity for target of 18,100."

8:45 am: Expert Take

Palak Kothari, Senior Technical Analyst, Choice Broking

"The momentum indicator MACD was trading with a positive crossover on a daily time frame which suggests strength in the counter. The support for nifty has shifted around 17,800 levels while on the upside 18,100 may act as an immediate hurdle. On the other hand, Bank nifty has support at 39,000 levels while resistance at 40,000 levels. Overall, the index is looking strong crossing above 18,000 marks will add more strength to the counter and head towards 18,200 levels."

8:20 am: SGX Nifty

The Indian market is likely to open lower today as SGX Nifty fell 47 points to 17,957. The Singapore Stock Exchange is considered to be the first indication of the opening of the Indian market.

8:15 am: Market on Thursday

Sensex closed above the 60K mark for the second consecutive session despite negative global cues. Sensex climbed 37.87 pts to 60,298 and Nifty gained 12 pts to 17,956. Of 30 Sensex stocks, 15 ended in the green. Kotak Bank, L&T and Bharti Airtel were the top Sensex gainers, rising up to 3.75 per cent.

Banking and capital goods stocks were the top sectoral gainers with their BSE indices zooming 305 points and 282 pts, respectively.