A recent report stated long-term investment strategies in equity mutual funds have demonstrated resilience, even in light of the monthly underperformance of major indices.

A recent report stated long-term investment strategies in equity mutual funds have demonstrated resilience, even in light of the monthly underperformance of major indices.

A recent report stated long-term investment strategies in equity mutual funds have demonstrated resilience, even in light of the monthly underperformance of major indices.

A recent report stated long-term investment strategies in equity mutual funds have demonstrated resilience, even in light of the monthly underperformance of major indices.Amidst the ongoing debate about investment strategies, a rising question is whether investors should choose a single aggressive hybrid fund over a combination of separate equity and debt funds. For investors who find 100% equity exposure a bit too aggressive but still want a balanced, growth-oriented portfolio, there’s a growing debate: should you invest in just one aggressive hybrid fund instead of managing separate equity and debt funds?

Many investors prefer a mix -- say, 60-70% in equities and 30-40% in debt -- to balance growth with safety. The traditional approach is to build a two-fund portfolio: one pure equity fund and one pure debt fund. This requires some manual effort—periodic rebalancing, tracking performance, and managing tax implications. According to Dev Ashish, Founder of Stable Investor, this DIY route may suit those comfortable with taking control of their investments.

But there's a simpler alternative: investing in a single aggressive hybrid fund.

As per SEBI regulations, aggressive hybrid funds must allocate 65-80% to equities and 20-35% to debt instruments. This blend offers dual exposure to both asset classes within one fund while keeping equity exposure high enough to benefit from long-term market growth. And yet, it’s structured conservatively enough to reduce volatility when compared to pure equity funds—making it a middle path ideal for moderate-risk investors.

Why aggressive hybrid funds make sense

Aggressive hybrid funds, as regulated by SEBI, allocate 65-80% of their assets to equities and 20-35% to debt instruments. This unique blend provides dual exposure to both asset classes, maintaining a high equity stake for long-term growth while reducing volatility compared to pure equity funds.

The biggest advantage lies in tax efficiency. Since these funds have more than 65% equity, long-term capital gains (LTCG) are taxed at 12.5%, even on the debt portion of the portfolio. That’s significantly better than holding debt funds separately, which are taxed according to your income tax slab—often as high as 30% for many investors.

Moreover, aggressive hybrid funds rebalance internally. That means the fund manager adjusts equity and debt allocations without creating a tax liability for the investor. In contrast, managing equity and debt funds separately would require you to sell units to rebalance, triggering capital gains taxes every time.

Take this scenario: you hold 65% in a Flexicap Fund and 35% in a debt fund. If equities rise, your allocation may shift to 72:28. To rebalance, you’ll need to sell equity units—incurring taxes. But in an aggressive hybrid fund, this same rebalance happens internally and tax-free.

How do they perform?

During strong equity rallies, pure equity funds—often holding 90–100% in stocks—tend to outperform aggressive hybrids. But when markets are choppy or falling, the 30–35% debt allocation in hybrids cushions the blow, making them more stable. For long-term goals, this balance can make a meaningful difference in returns vs. risk.

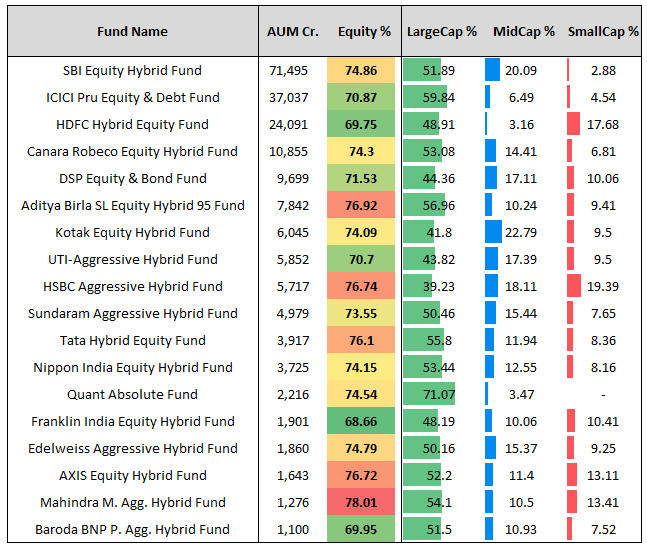

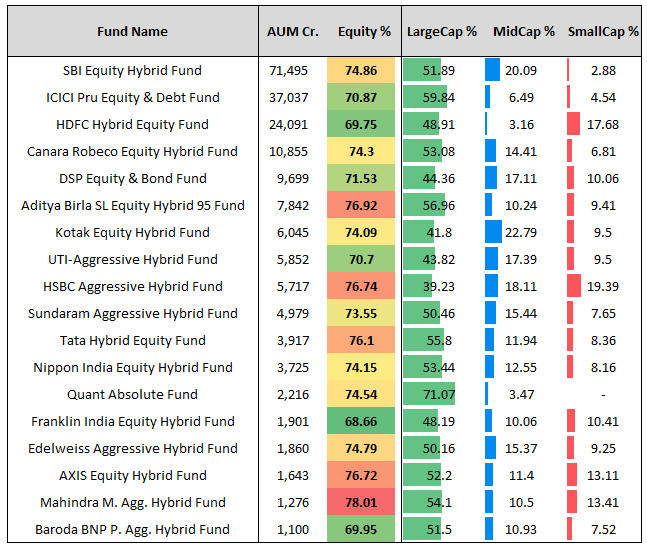

Currently, the aggressive hybrid fund category comprises 30 schemes with a total AUM of ₹2.06 lakh crore, with the top five schemes accounting for nearly 75% of the total. While most funds maintain similar equity-debt mixes, their strategies vary—some may focus on large-caps, others on mid- or small-caps. So investors must choose a fund aligned with their risk appetite.

The cost factor

One potential downside is higher expense ratios. Aggressive hybrid funds may cost a bit more than standalone equity or debt funds. However, the difference is marginal and arguably justified, given the tax benefits and hands-off rebalancing they offer.

Final word

For medium to long-term financial goals, an aggressive hybrid fund offers simplicity, diversification, tax efficiency, and automatic portfolio balancing. While it may not always deliver the highest returns compared to pure equity funds, it smoothens the ride—and for many investors, especially those with moderate risk tolerance, that makes all the difference.