RBI Governor Shaktikanta Das

RBI Governor Shaktikanta Das

RBI Governor Shaktikanta Das

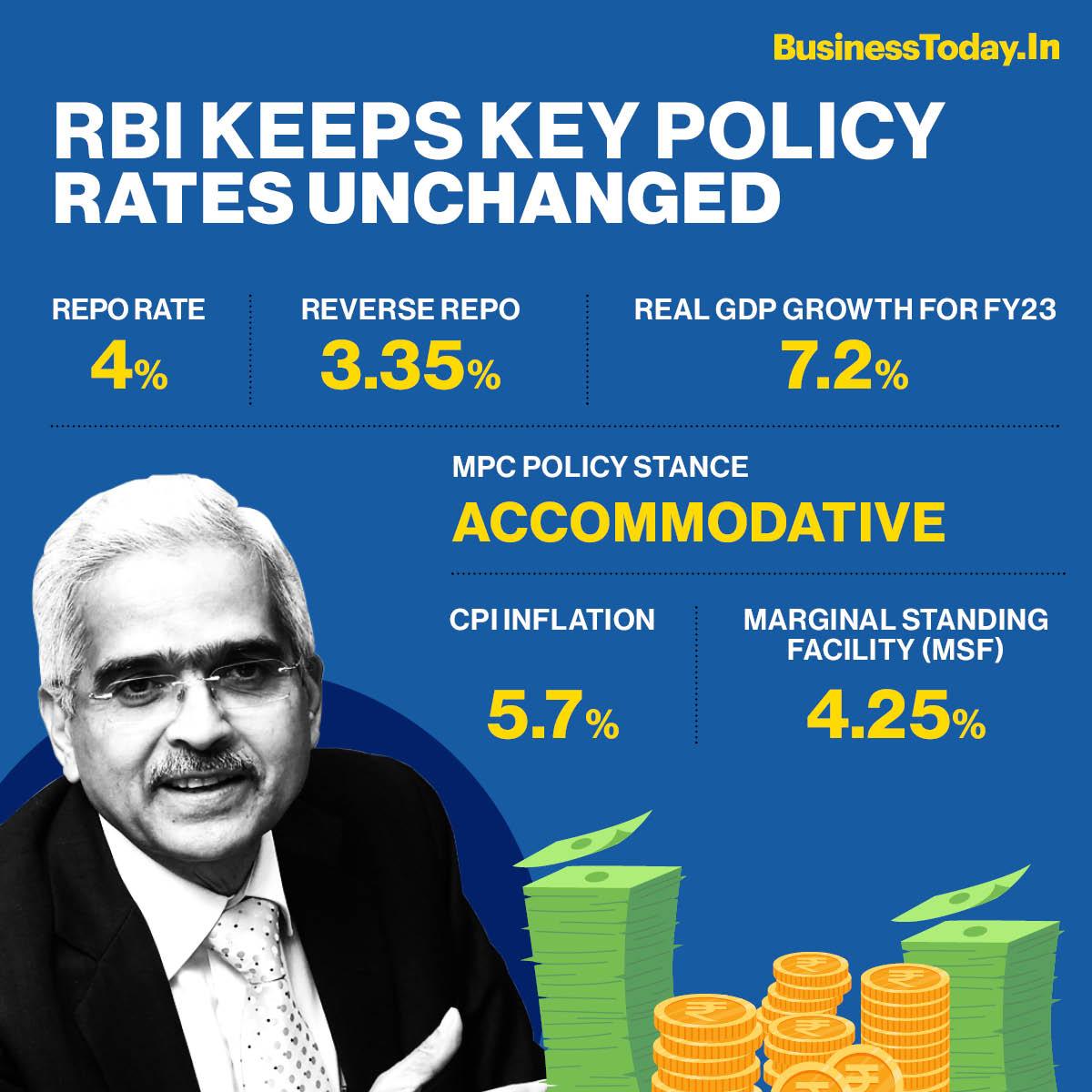

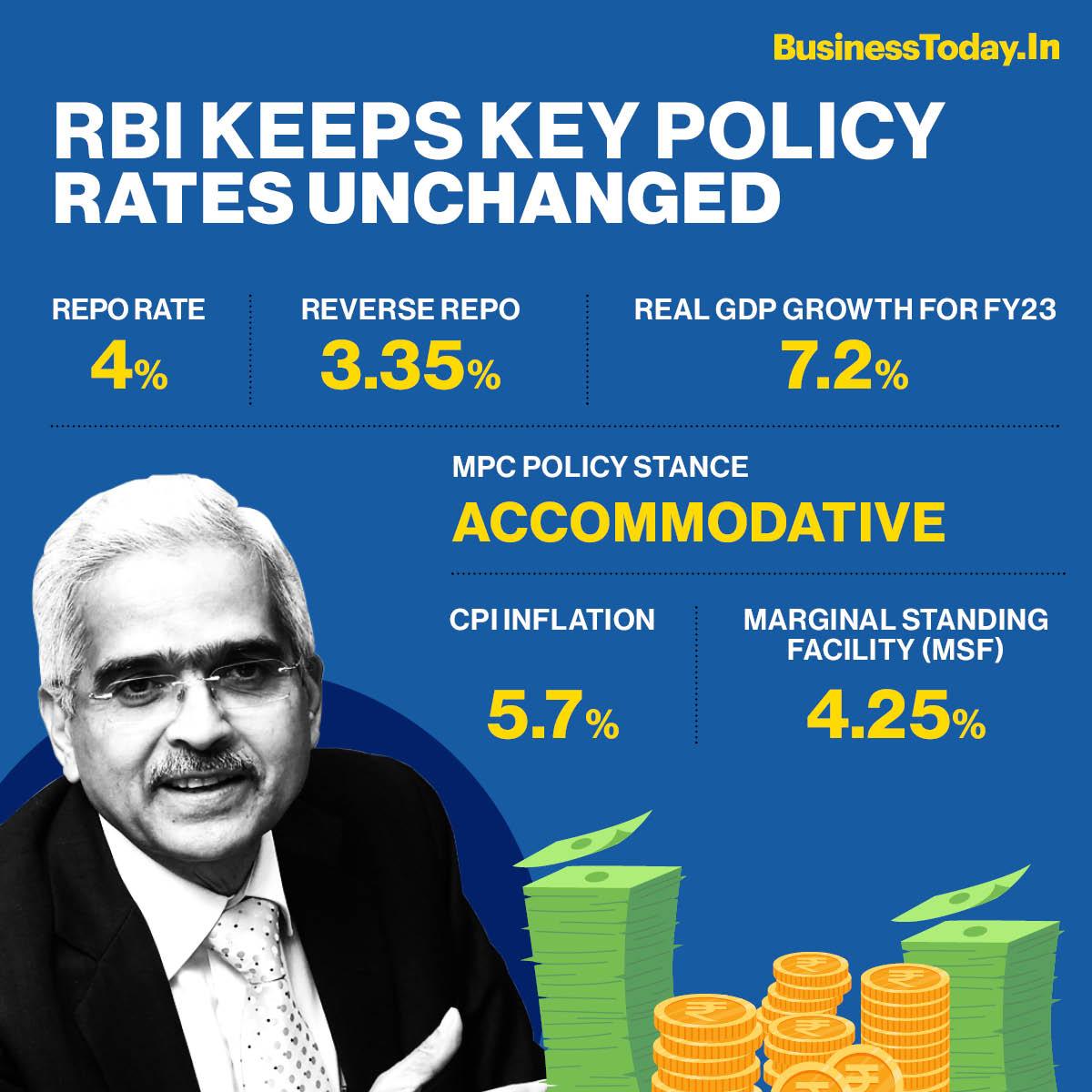

RBI Governor Shaktikanta DasInflation has been pegged at 5.7 per cent in 2022-23, RBI Governor Shaktikanta Das said during the latest monetary policy committee (MPC) meeting. The central bank had earlier projected inflation rate for FY 23 at 4.5 per cent. He projected inflation rates for FY23 at 6.3 per cent for Q1, 5 per cent at Q2, 5.4 per cent at Q3 and 5.1 per cent at Q4.

The RBI boss said that India is in a quagmire of “new but humongous challenges.” These include shortage of key commodities, fractures in international financial architecture, and apprehensions around de-globalisation. He also explained that supply chain disruptions have rattled global commodities and financial markets.

"Protracted supply disruptions have rattled global commodities and financial markets. Given the significant share of two economies engaged in the war in global production and exports of key commodities like oil and natural gas, wheat and corn, palladium, aluminium and nickel, edible oil and fertilisers," he explained.

He added that global crude oil prices have been on a rage as they crossed $130/bbl, highest since 2008 and still continue to remain volatile while also mentioning that risk aversion to assets of emerging markets has increased.

The RBI governor noted that any projections of growth and inflation are “fraught with risk and is contingent on future oil and commodity price developments.”

IMF Executive Director for India, Bangladesh, Bhutan and Sri Lanka Surjit Bhalla said that India has largely experienced supply side inflation due to food shocks, which is now a rarity due to good management.

“What is the case is that India has had the most experience with supply side inflation because of food shocks. Don’t have a food shock anymore because of good management. There have been several governors who said – arre food shock ho gaya hai, inflation ho gayi hai, let’s increase interest rates. So, I think for the monetary policy, the world and India has gone through a rethink,” Bhalla underlined.

Meanwhile, the central bank has kept the repo rate unchanged for 11th time in a row. The MPC, however, hiked reverse repo rate from 3.35 per cent to 3.50 per cent. It also kept marginal standing facility unchanged at 4.25 per cent. The RBI has also decided to maintain accommodative stance to support economic growth and recovery.

The three-day RBI MPC for firming up next bi-monthly policy began on Wednesday.