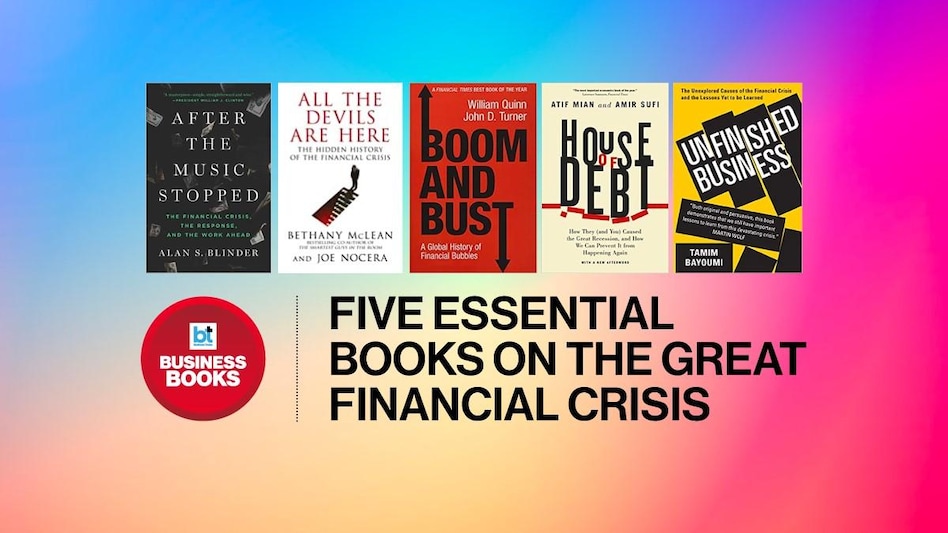

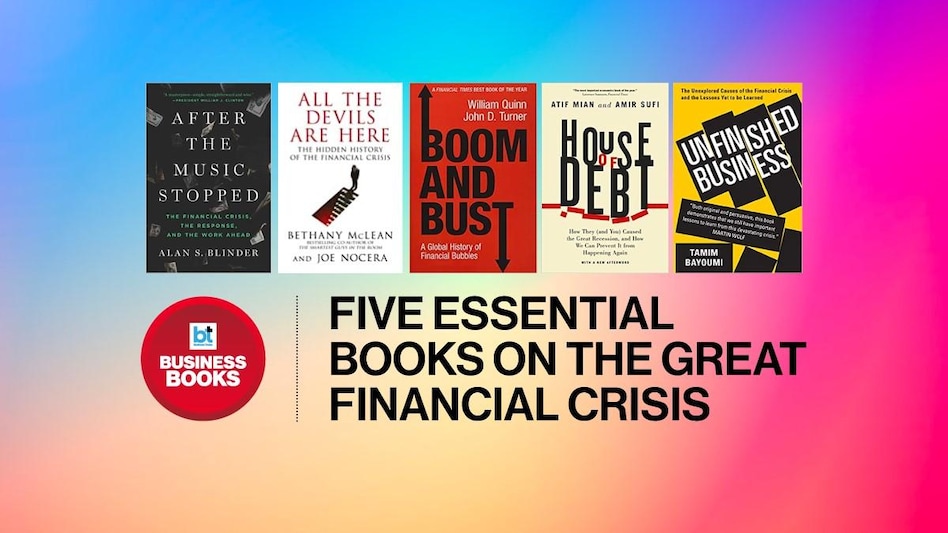

What caused the global financial crisis in 2008? These books will help you dig up the details

What caused the global financial crisis in 2008? These books will help you dig up the details

What caused the global financial crisis in 2008? These books will help you dig up the details

What caused the global financial crisis in 2008? These books will help you dig up the detailsThe financial crisis of 2008 served as a major blow that shook economies across the world. The current global economic situation is once again making the subject worth reading about. Stock market crashes, currency crises, and financial bubble bursts are all causes of a financial crisis. Books on the financial crisis have been written and read for decades. Some are analyses, some are suggestions, and some are predictive by nature. There are multiple economic studies of how financial crises happen and the events that lead to them. A financial crisis in one corner of the world eventually affects the world economy. Here are the top five books that best explained the 2008 crisis.

History repeats itself which is why studying it prepares us for future events. When America's financial structure crumbled in 2008, the damage was deep. The world realised how every system is ultimately interconnected and exposed the fragility of the global economy. After the Music Stopped is an important read with key insights.

The great recession led to the loss of over eight million jobs between 2007 and 2008. More than four million homes were foreclosed. Atif Mian and Amir Sufi in House of Debt show how the Great Recession and Great Depression and the current economic malaise in Europe are caused by a large run-up in household debt followed by a huge drop in household spending. The big question it picks up to analyse is: Why do severe recessions happen?

Business journalists Bethany McLean and Joe Nocera claim in the book that no one has put all the pieces of the 2008 financial crisis together. All The Devils Are Here goes back several decades to explore the motives of CEOs, politicians, lenders, borrowers, and Wall Street traders. It delves into the homeownership conundrum. And proves that the crisis ultimately was about human nature.

Stock and housing markets go through continuous cycles of booms and busts. Why does this happen? Authors William Quinn and John D. Turner narrate the history of financial bubbles and take us through Paris and London in 1720, Latin America in the 1820s, Melbourne in the 1880s, New York in the 1920s, Tokyo in the 1980s, Silicon Valley in the 1990s and Shanghai in the 2000s.

This book has a prescription for the prevention of a financial meltdown but before that, it explores how under-regulated trading between European and American banks led to the 2008 financial crisis. Bayoumi is the first to explore the inter-continent interlink with reference to the financial crisis. Bayomi goes back to the 1980s to dig into the roots of shadow deals that ultimately crashed the economy. The book also concludes that policymakers are still unaware of how to clean the system to prevent future debacles.