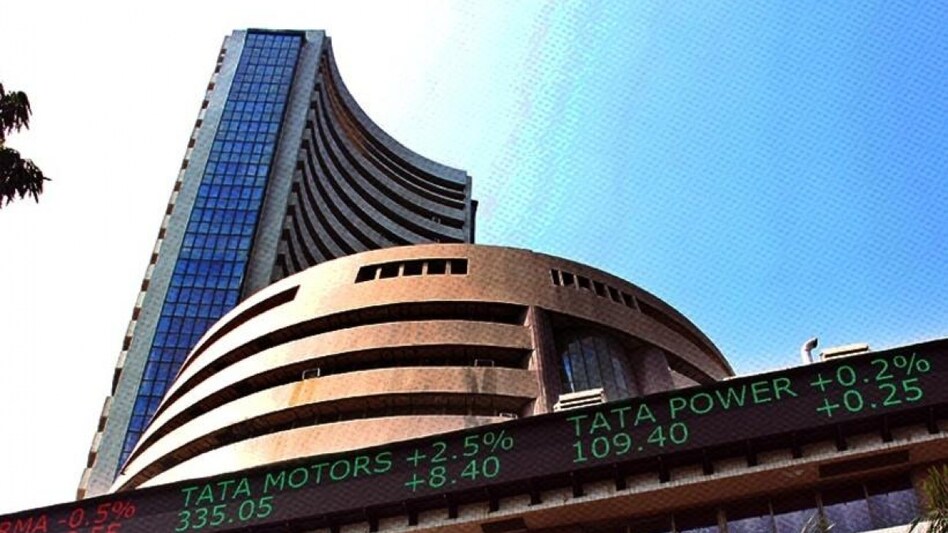

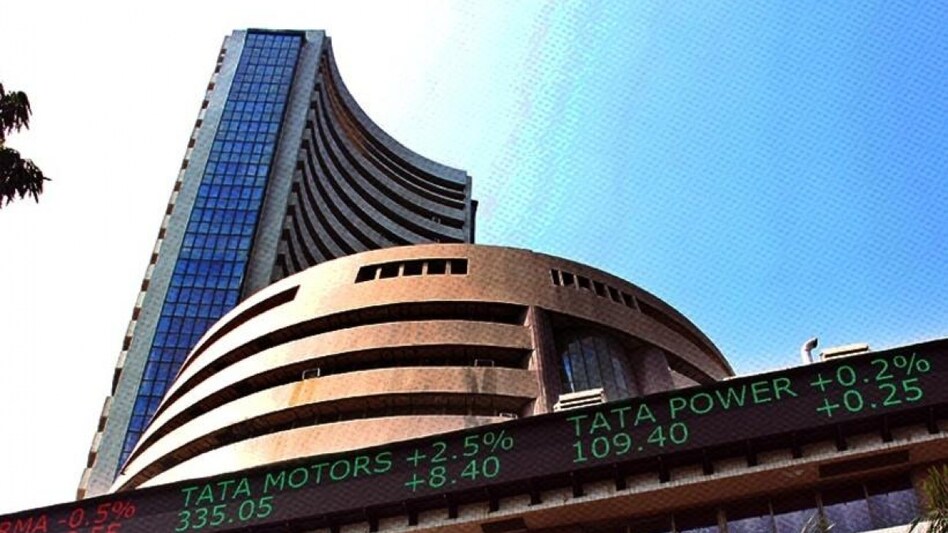

Market capitalisation (m-cap) of BSE listed firms slipped to Rs 317.33 lakh crore compared with a valuation of Rs 319.21 lakh crore recorded on Tuesday.

Market capitalisation (m-cap) of BSE listed firms slipped to Rs 317.33 lakh crore compared with a valuation of Rs 319.21 lakh crore recorded on Tuesday.

Market capitalisation (m-cap) of BSE listed firms slipped to Rs 317.33 lakh crore compared with a valuation of Rs 319.21 lakh crore recorded on Tuesday.

Market capitalisation (m-cap) of BSE listed firms slipped to Rs 317.33 lakh crore compared with a valuation of Rs 319.21 lakh crore recorded on Tuesday. Benchmarks indices fell sharply in early deals today, led by losses in banks, financials, automobile technology, metals and energy stocks. Sensex slumped 459 points to 65,052 while Nifty slipped 133 pts to 19,395. Fear gauge India VIX jumped 3.07 per cent to 3.07-level.

Market capitalisation (m-cap) of BSE listed firms slipped to Rs 317.33 lakh crore compared with a valuation of Rs 319.21 lakh crore recorded on Tuesday.

IndusInd Bank, Axis Bank, Bajaj Finserv, NTPC, Maruti and Ultratech Cement were the top Sensex losers, falling up to 3% in early trade.

Here’s a look at major factors behind the market crash today.

Weakness in global markets

The Asian markets were trading deep in the red. Japan’s benchmark Nikkei 225 slipped 665 pts to 30,572. South Korea’s Kospi shed 55 pts to 2,409 and Hong Kong’s Hang Seng slipped 179 pts to 17,151. In Europe, Germany's DAX ended 162 pts lower at 15,085 and the CAC 40 in Paris lost 71 pts to 6997.05. Britain's FTSE 100 was down 40 pts to 7,470. In the US, Dow Jones ended 431 pts lower at 33,002 and Nasdaq slipped 248 points to 13,059. S&P 500 lost 59 points to 4229.

FII selling

Foreign institutional investors (FII) sold Rs 2034 crore worth of Indian equities in the cash market on Tuesday. On a cumulative basis, FIIs have net sold Rs 26,692.16 crore worth of equities in September. FII selling is exerting negative sentiment on the market.

Rise in dollar index

The US dollar index is trading at a one year high, giving investors a reason for dumping Indian stocks and put their money in the US market. It currently trades at 107.17 level.

Rising bond yields in US

Yields on the benchmark US 10-year Treasury stood at around 4.848%, a multiyear high. The better returns from govt bonds yields has prompted investors to withdraw their money from India and park it in the US. The surge in yields came a day after Cleveland Fed President Loretta Mester said that one more rate hike might be necessary later this year. This was against expectations of the market which sees no hikes at the Fed's upcoming November and December meetings.

Also read: IOB, Union Bank, UCO Bank, BOI, other PSU bank shares climbed up to 52% in 30 days. Here's why