Under Section 80RR, Indian residents who are authors, artists, actors, musicians, or sportsmen can claim tax deductions on foreign income earned from their professional work

Under Section 80RR, Indian residents who are authors, artists, actors, musicians, or sportsmen can claim tax deductions on foreign income earned from their professional work

Under Section 80RR, Indian residents who are authors, artists, actors, musicians, or sportsmen can claim tax deductions on foreign income earned from their professional work

Under Section 80RR, Indian residents who are authors, artists, actors, musicians, or sportsmen can claim tax deductions on foreign income earned from their professional workCricket icon Sachin Tendulkar may be celebrated as the “Master Blaster” on the field, but off the field, he once made headlines for a completely different reason — proving that he was also an actor to save on taxes. Over a decade ago, Tendulkar found himself in a legal dispute with the Income Tax Department over how his foreign earnings from brand endorsements should be classified under the Income Tax Act.

Sujit Bangar, Founder of TaxBuddy.com, recently revisited this intriguing case on the social media platform X (formerly Twitter). “Sachin Tendulkar wasn’t a ‘cricketer.’ He claimed he was an actor — to save ₹58 lakh in taxes. The tax officer raised a demand on him. But here’s how the Master Blaster proved he was an actor, not a cricketer, and won the case,” Bangar wrote.

The background

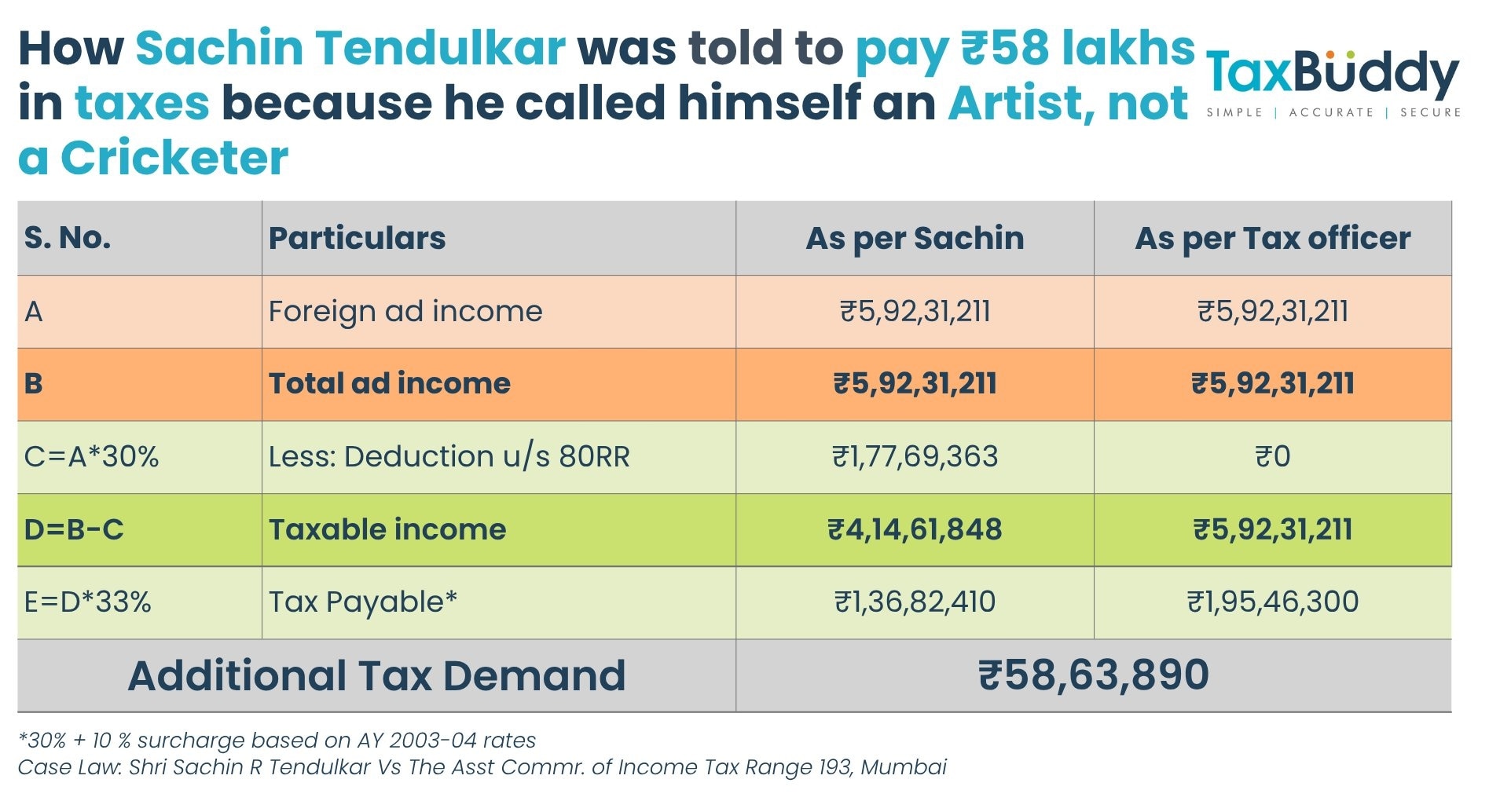

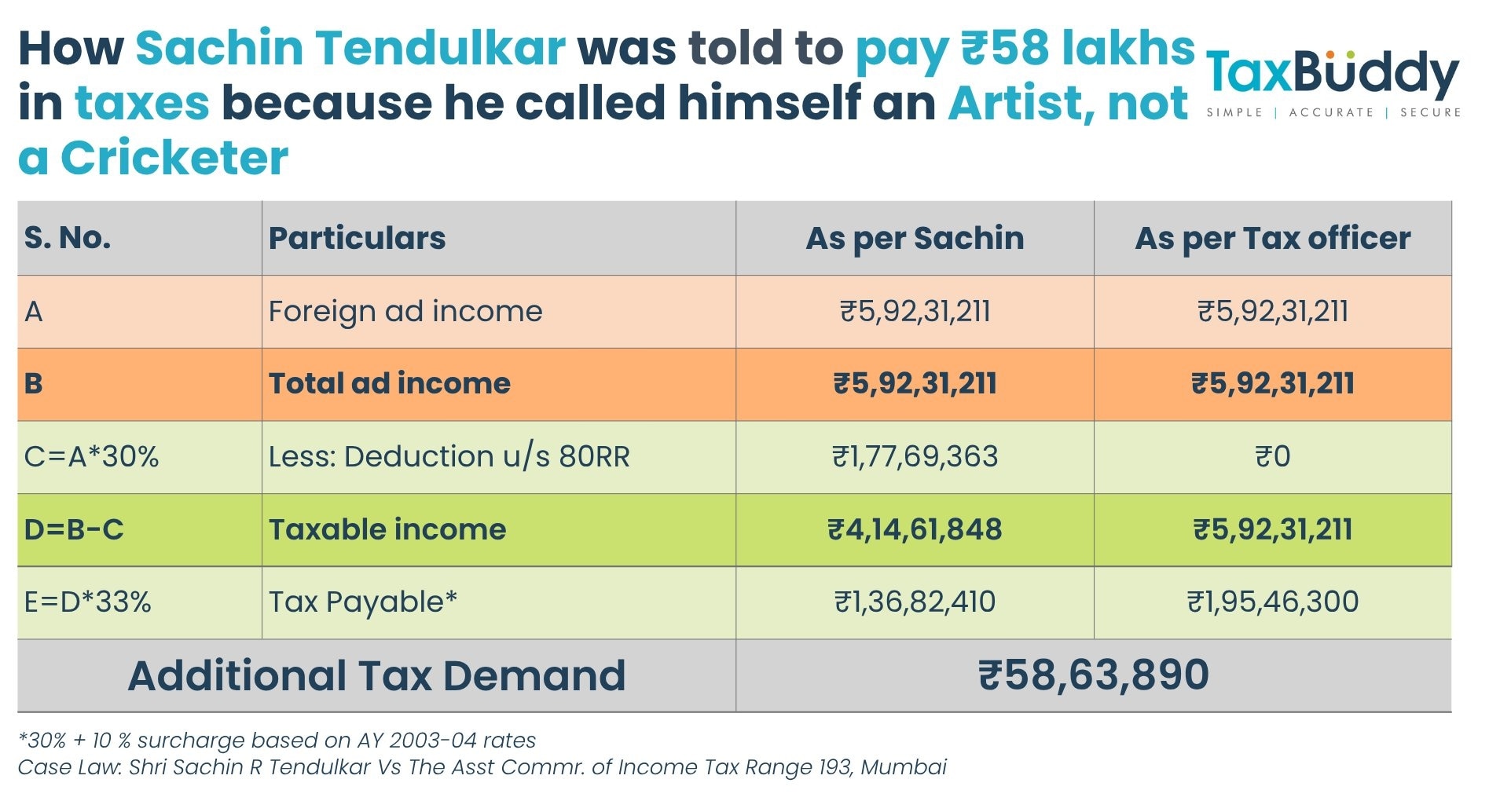

The case dates back to the assessment years 2001–02 and 2004–05, when Tendulkar earned significant foreign income from his endorsement deals with brands such as Pepsi, VISA, and ESPN-Star Sports. He declared a foreign income of around Rs 5.92 crore and claimed a 30% tax deduction under Section 80RR of the Income Tax Act, amounting to nearly Rs 1.77 crore.

The Income Tax Department, however, objected to this deduction. It argued that Tendulkar’s endorsement income was merely incidental to his profession as a cricketer and not directly linked to it. Therefore, the department maintained, it should be classified under “income from other sources,” not “professional income.” As a result, the department disallowed the Section 80RR deduction.

“You are a cricketer,” the assessing officer reasoned. “Endorsements are not part of your profession. So, you can’t claim this benefit.”

What was the case

Tendulkar’s response was both creative and logical. He contended that appearing in advertisements and promotional videos required acting and modeling skills — activities that clearly fell under the definition of an artist’s or actor’s work. “I performed in commercials; that’s acting. The law allows deduction under 80RR for such artistic work,” he argued.

He further explained that an individual can have more than one profession — and in his case, while cricket was his primary one, acting for advertisements was an independent professional activity.

What the law says

Under Section 80RR, Indian residents who are authors, artists, actors, musicians, or sportsmen can claim tax deductions on foreign income earned from their professional work. The key question before the authorities was whether advertising and modeling could be considered as “acting” within the meaning of the law.

The verdict

The matter eventually reached the Income Tax Appellate Tribunal (ITAT), which delivered a landmark ruling. The Tribunal observed that the definition of “actor” cannot be narrowly restricted. It ruled that work involving skill, imagination, and creativity—such as appearing in TV commercials—qualifies as acting.

The ITAT concluded that Sachin’s advertising income was derived from artistic performance and not from cricketing activities. Therefore, he was entitled to the Section 80RR deduction.

The outcome

With the Tribunal’s ruling in his favour, Tendulkar was allowed to claim the deduction of Rs 1.77 crore, leading to tax savings of about Rs 58 lakh.

This unusual but instructive case highlights an important principle in professional taxation: a person can legitimately have more than one profession. As Sujit Bangar aptly summed up, “One person, two professions. The ad income arose from the actor profession.”

Sachin Tendulkar’s case remains a fascinating precedent in tax law — proving that even the world’s greatest cricketer can play a very convincing role as an actor when it matters most.